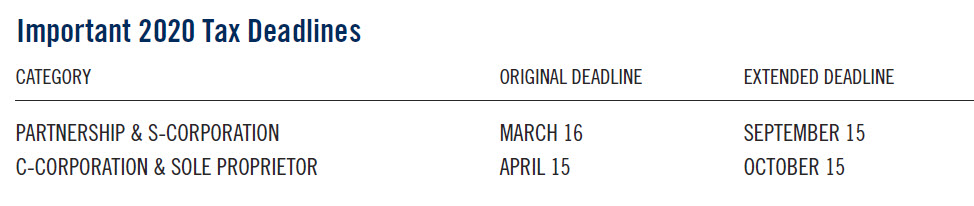

Mark your calendar to submit or expend by these dates

Resolved to get ahead of tax deadlines this year? It’s time to start gathering your 2019 tax forms and financial records to send to your tax preparer for the 2020 filing season.

Here are 2020’s important IRS dates and deadlines to mark on your calendar.

There’s still time to compile your documents and determine if an extension is right for you. Take note of these important deadlines for 2020:

- March 16: Partnership and S corporation returns are due. If you need to file an extension, that is due March 16 and extends your deadline to Sept. 15.

- April 15: Personal, Trust and C corporation returns are due. If you need to file an extension, that is due at this time and will extend your deadlines to Oct. 15.

For CWA clients taking advantage of our tax services, be aware of the deadlines, but remember we do all the filing for you. However, please keep an eye out for any communication from the tax department regarding document needs.

Not a tax client, but interested in knowing how it could simplify things for you? Proper tax planning can not only simplify, but positively affect your journey to reaching your financial goals. Visit us here to learn more about our tax preparation and filing services.

Cain Watters is a Registered Investment Advisor. Cain Watters only conducts business in states where it is properly registered or is excluded from registration requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. Request Form ADV Part 2A for a complete description of Cain Watters investment advisory services. Diversification does not ensure a profit and may not protect against loss in declining markets. Past performance is not an indicator of future results.