Most things in life are meant to grow and mature over time, and that includes your financial plan. There is a defined financial lifecycle that, if navigated correctly, can help you reach your financial goals more quickly.

The average investor generally understands the three variables to an investment plan, amount of money saved, time and rate of return. This foundational concept to investing is essential to understanding each of the three phases in the overall financial lifecycle: Accumulate, Preserve and Perpetuate.

Each phase plays an important role in helping you grow, enjoy and pass on the spoils of your hard work through proper investing. Everyone experiences the three phases of the financial lifecycle whether they realize it or not, and everyone can leverage this financial knowledge to accomplish their big, long-term goals. It’s never too late to start investing your money wisely.

To understand the phases and how they work together, we first have to understand that they are not created equal. As you might guess, the Accumulate phase is the longest and most arduous of the three.

Phase 1 – Accumulate

Just as the name infers, the Accumulate phase is all about gaining and growing wealth. It begins when your career begins, and starting the accumulation process right away is vital to achieving ultimate financial success.

According to Darrell Cain, CWA founder and architect of the Accumulate, Preserve and Perpetuate construct, if you wait until you have extra income to start accumulating, you’ll miss a huge window of time when your money could be growing via compound interest.

The concept is based on the premise that a principal sum of savings gains interest over time. By reinvesting that interest, it adds to the principle, in such that the interest accumulated in the next period is added to the principal sum thus increasing the previously accumulated amounts.

“Do not wait to start accumulating wealth until you are wealthy,” says Darrell. “About 95% of the money you will have later in life is determined by how much you accumulate in this phase, so the earlier you start, the better.”

Building long-term wealth shouldn’t start after you’ve paid off all your debt either. Of course, things like student loans and the mortgage cannot be ignored, but it’s important to understand that actively contributing to your long-term goals today is essential. At this point in your life, the amount of money you set aside is most important. Time is on your side, use it and get started early.

It’s important to note that Darrell uses the word “accumulate” rather than “save.” According to Darrell, this change in perspective helps many people be successful in this phase.

“We’re not asking our clients to scrimp and save for 30 years to accumulate wealth,” says Darrell. “The goal during this phase is helping our clients make and keep more money.”

To do this, you must consider both the business and personal sides of your financial life. As a business owner, cutting costs and increasing production in creative ways is the goal.

Personally, having a tax strategy that maximizes your savings and take-home pay is what financial advisors should be focusing on. Things like creating a personal budget is important as well. Both of these play a vital role in making sure you can save the amount you need to reach your goals while living the lifestyle you want to.

Darrell reminds investors in this stage of the four key priorities that can speed up the accumulation phase:

- Understand how money grows (i.e., amount saved x time x rate of return)

- Commit to your personalized savings plans (the earlier you start the better!)

- Grow the savings through proper investment allocation

- Keep what you’ve earned through tax strategies and insurance

Ideally, the end goal of the Accumulation phase happens when you’ve reached what Darrell calls the 3 to 1 ratio of money growth. This concept, coined by Darrell over 35 years ago, is a fundamental tenet of the CWA investment philosophy.

How it works is, once a person’s money starts earning $3 in returns for every $1 invested, the investment has reached an optimal growth rate for quickly building long term wealth without a significant new investment needed.

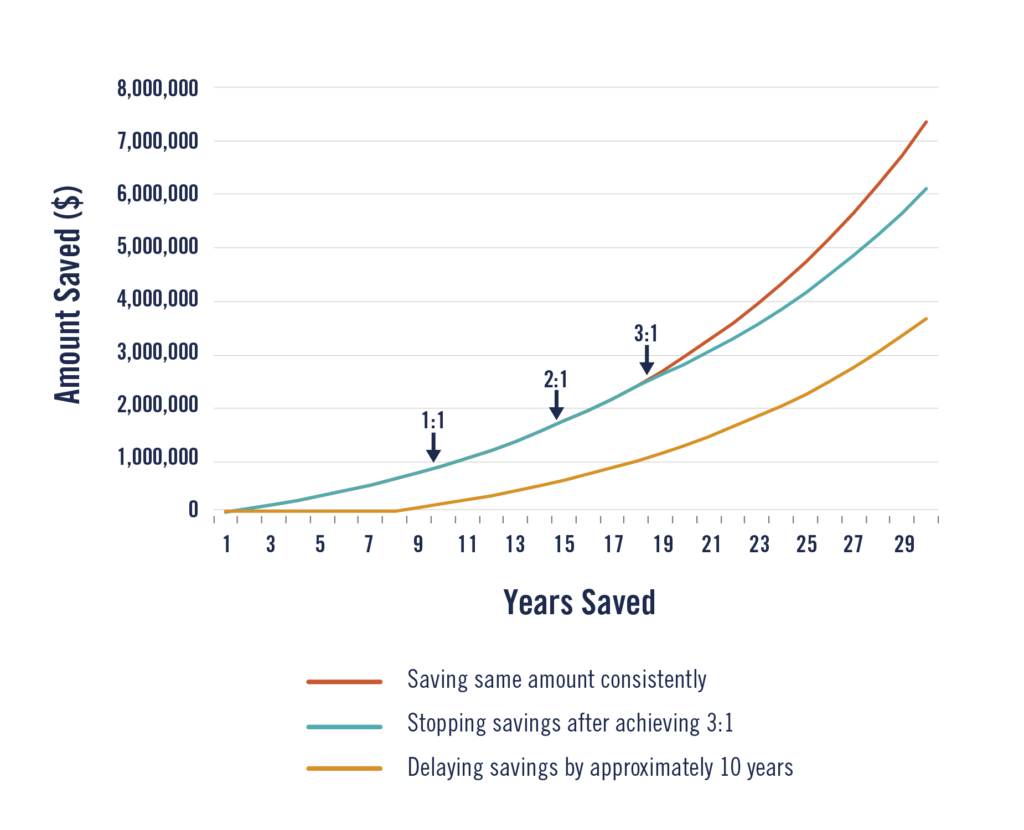

It sounds easy, but this is where the rubber meets the road for any serious investor. Take a look at the chart below that illustrates this concept. Assuming for this scenario they are able to save $60,000 a year consistently with a 8% rate of return, it still takes almost 10 years to reach 1 to 1 ($1 return for every $1 saved). This is the stretch that feels never-ending and is the hardest to stay focused.

It takes a while for investment savings to start producing a return that feels meaningful, everyone needs to find their inspiration to stay the course. As you can see, for this focused investor in the chart below, the 2 to 1 milestone comes even quicker—3 to 1 even more quickly than that. Read more on this example.

“Often times, clients take that last step towards reaching 3 to 1 when they sell their practice,” says Darrell. “At this point, behavior shifts from actively saving to focusing on leaving your money for as long as possible to allow it to possibly even hit 4 to1, 5 to 1 and beyond.”

Phase 2 – Preserve

It takes a while to get to the Preserve stage, but it’s well worth the wait. At this point you have accomplished a major financial milestone of 3 to 1 wealth accumulation. Amazing!

Now it’s time to focus on preserving what you worked so hard to build. This mental reset is what Darrell says can be emotionally challenging for some clients.

“You’ve been working, earning, saving, building wealth for 20 or 30 years…it can be an uncomfortable behavior shift from building wealth to maintaining it, but it can also be quite rewarding,” added Darrell with a smile.

When you reach the point in time where you need to access your money, the interaction between the amount pulled out and how it is invested is crucial. CWA consultants evaluate many factors when establishing a client’s safe withdraw rate (typically 4-6%) to land on a percentage that will keep their nest egg intact as long as they need it.

As you age, your estate plan will be more important than ever. If you’ve done the hard work of Accumulating, the waiting in the Preserving, you can enjoy a different fruit of your labor in the Perpetuate stage.

Phase 3 – Perpetuate

The final phase of the financial lifecycle, the Perpetuate phase, focuses on creating sound strategies around the assets you are ready to or will eventually pass on.

“As unpleasant as it may be, the reality is, we’re all going to die,” says Darrell. “We rarely ever know when, so the odds are we will die with money.”

Depending on your situation and your personal intentions, this is a time for some to begin strategically gifting money and assets to their heirs. It not only allows investors to take advantage of gifting taxes, but can offer a level of comfort in getting to see your wishes carried out.

“Gifting money to heirs while you’re still around to watch them enjoy it can be incredibly rewarding,” says Darrell. “Many people find a lot of purpose and personal satisfaction in watching the next generation thrive, and knowing they helped play a part in that success.”

Regardless of your gifting wishes, it’s important to understand that 90% of inheritance is gone within 20 years. Your advisor should set your estate in order to maximize tax savings for heirs and minimize questions and confusion during what will inevitably be an emotional, confusing and stressful time.

The key is to get all parties educated and on the same page earlier rather than later, while all parties are still in a good place both physically and mentally.

“We facilitate family meetings of the adult children and our clients,” says Darrell. “We go over everything…how it works, how it’s set up…the goal is to help everyone involved feel comfortable with the process.”

Closing Thoughts

Everyone experiences the three stages of the financial lifecycle that we’ve defined above. Some get started later than others and some never take advantage of investing options. You have the power to change the course you are on at any point of your financial life to get on the path towards financial freedom.

You or someone you know may benefit from these free resources that can help any investor understand these fundamental concepts:

No matter what stage of the financial lifestyle you are in, CWA is here to help maximize your savings opportunities and get you closer to your financial goals. Contact our team to get started today.