Long-Term Strategies Capitalize on Market Dislocation

The words “Happy New Year” need not apply when it comes to the markets in 2022. Volatility began at the onset of the year and has continued for the first three weeks. As of intraday on January 24, the S&P 500 is down -9.2% for the year, the NASDAQ is -13.2%, and Small Caps are down -11.5%. The bond market is also down -1.5%.

Judging by the tone of the emails in our inbox, the veracity of the decline has caused investors to get nervous. This is within reason.

Dating back to the middle of December 2021, the markets have had to digest the Federal Reserve turning hawkish and changing course on the timeline for rate increases, an increasing spate of negative COVID news as Omicron has spread seemingly unabated, an almost constant feed of negative geopolitical news, continued high inflation data, and a round of earnings announcements that have fallen short of lofty expectations.

This is a lot for the market to digest during normal times, much less following a 24-month period where the S&P 500 has returned a cumulative 52.3% in the face of a pandemic and the ensuing economic uncertainty.

THE SEARCH FOR SMOKE SIGNALS

This period of uncertainty, both in and out of the market, seems to elevate the erratic behavior of investors. Investors, behaviorally, tend to never want to be first to act and therefore pile on at the first mention of a warning signal.

None of this is more apparent than looking at what has happened to Netflix (NFLX) in the past two trading days. NFLX announced last week that it had added 8.3 million new subscribers in the 4th quarter, approximately 2.5% below their estimate of 8.5 million new customers. The stock has fallen over 27% since this announcement late last week.

This NFLX example can be applied to other stocks in the market. Is a 200,000 subscriber miss enough to knock almost a third out of their market capitalization? That does not seem logical. Was the stock too expensive to begin with and this is reality setting in? Perhaps, but NFLX has traded at an expensive valuation for the better part of a decade, so what has changed now? These are questions that are important to ask ourselves.

The conclusion we draw at this moment is that investors are wide eyed at the returns they have received over the past two years. Afraid of incurring losses, they are spring loaded to bail the moment trouble sets in. The disorder in the market over the past three weeks is indicative of this mindset.

KEEP FOCUS ON THE LONG TERM

It is during these times that great investments are made. When others are fearful, asset prices get dislocated. A patient long-term investor can take advantage of the rampant selling and turn that in to outsized returns. The market has had fits like these several times over the past five years and yet has continued to march higher. We believe this market is no different.

The market may exit this round of volatility with a new batch of stocks leading the way and certain indexes may not bounce back as they have in the past, but that can be an area of opportunity, not something to hide from.

We will leave you with this:

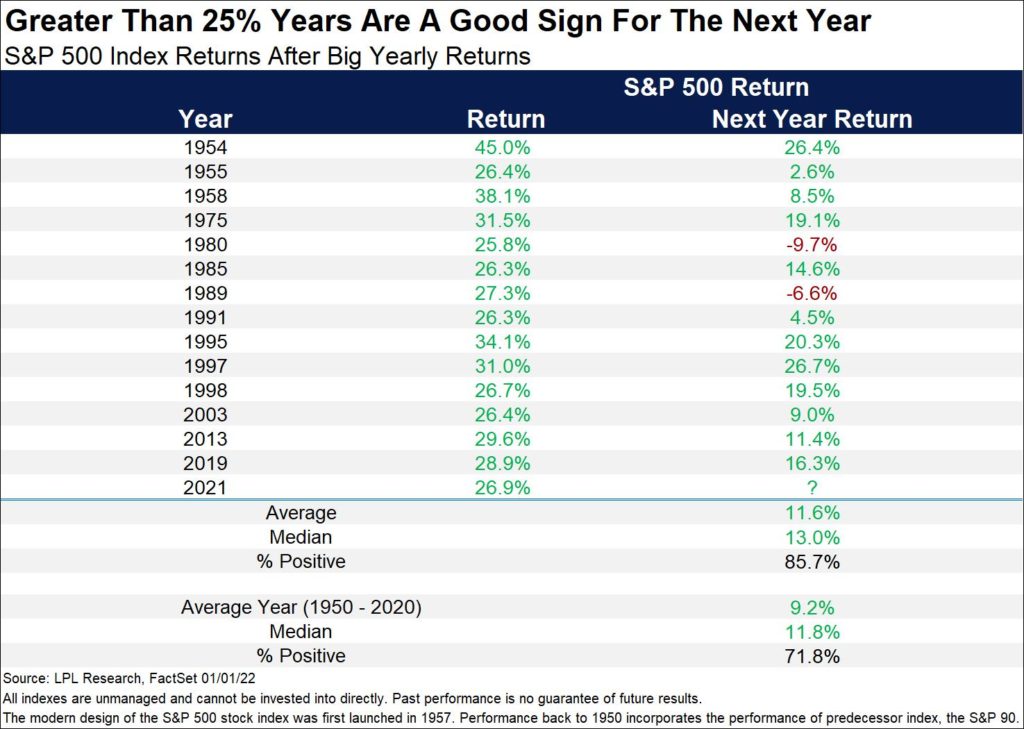

Common thinking and the wiring of our human brains would lend us to believe that markets probably sell off historically when the market has been up over 25% the prior year. That is, however, not the case. As shown in the table below, only twice since 1950 has the market dropped the year following a 25%+ gain, and in both of those instances the market was only down single digits.

While the market has not given us much to cheer about in the three short weeks to start the year, it is not time to think short-term and try to micromanage the volatility. Rather, look forward and use history and evidence to make plans to take advantage of the market dislocation.

In times like these, the key is to remain focused on the long-term. Remain invested and look for opportunities to invest for the long-term. This is one of the many reasons we rely on primarily active management, as these opportunities present themselves often.

Source: LPL Research, FactSet 01/01/22

Our goal-based investment strategies are designed to secure a financial future with the primary goal of sustaining a lifetime. View our investment resources and see what a difference a strategic change can make.