2022 Economic Market Year in Review

Written by Brad Sanders, CFA, Managing Director, Tectonic Advisors

November 15,2022

We have been spoiled for way too long. Markets, absent a few short periods, have been very good to investors after the 2008 financial crisis.

Spurred by zero interest rate policy, quantitative easing (QE), an expanding Fed balance sheet and increasingly loose lending terms, the markets drug years of growth forward. Areas of the market, technology the most prominent, began trading at valuations not seen since the dot com days of the late 1990s.

The risk with investing is the threat of the down markets. However, this market environment feels palpably worse, with the dual forces of behavioral biases erasing investor memory of market pullbacks, and add to it inflation rearing its head.

As distressing as it has been this year, we have become more constructive on the markets going forward than we have been in five years.

With volatility comes opportunity.

Inflation, Interest Rates and The Bond Market

As late as Thanksgiving of 2021, interest rates were near zero, the Fed was signaling loose monetary conditions going forward and characterizing inflation as “transitory.” A short 60 days later, the Fed changed course and signaled aggressive interest rate hikes to combat inflation that had become more entrenched than they previously surmised.

Over the next 10 months, the Fed funds rate increased from near zero to roughly 3.8% as of this writing. Inflation persisted despite the Fed hiking rates 0.75% at a time, something that was not on any market participant’s radar a year ago.

At the lows in October 2022 the bond market, as measured by the Bloomberg Aggregate Index, was down over 16%. Typically, when the equity market softens, the bond market at worst treads water and provides stability to a portfolio allocation. This year was different.

A good portion of the losses in bond portfolios year-to-date are still due to lack of liquidity. As of this writing, the yield to maturity on the Aggregate Bond Index is approaching 5%.

The U.S. Dollar

One consequence of the Fed aggressively hiking rates is it turned into a mechanism to export inflation to the rest of the globe.

Under a heavily globalized economic system, everything human beings need to survive – food, water, energy, etc., is priced in U.S. dollars.

The Fed embarking on their hiking cycle this year caused a dollar funding crisis globally. The U.S. dollar became stronger than it has been in over 30 years.

This does not sound like such a bad thing on the surface, but central banks outside of the U.S. are combating their own problems and are trying to keep their monetary policy loose to combat recessionary forces. By doing so, the U.S. dollar has become precious and dollar liquidity in the global system has steadily evaporated.

You can draw a straight line from dollar strength, particularly from late March 2022 onward, and risk asset performance. The directionality of the dollar will dictate future performance of the equity market and the bond market alike.

The Equity Market

It has been long communicated our lack of concentration in mega-cap technology – particularly Meta (formerly known as Facebook), Apple, Amazon, Netflix, Google and Microsoft (FAANGM).

Reticence to invest heavily here was less an indictment on any one particular company, but rather a combination of being wary of market history after assessing the market capitalizations these companies reached. At their peak these six companies comprised over 25% of the entire market capitalization of the S&P 500. This did not make sense when taking a long-term view of the market.

Fast forward to today and the pain has been acutely felt in the NASDAQ. At the low in early October 2022, the S&P 500 was down -24.8%, while the NASDAQ was down just shy of -33%.

The best performing stock of the FAANGM group was Apple (-21.4%) while the worst two were down almost triple that of AAPL (META -61.8%, NFLX -64.4%). The market was top heavy and the indices succumbed to the selling pressures on the larger holdings.

In the CWA Investment Committee monthly

videos and investment reports, we opined that the market was near term extremely oversold in late September 2022 and that we wouldn’t be surprised if we saw a rally in the very short term.

That observation proved to be prescient. Overall, as of today, Nov. 15, 2022, the S&P 500 is -15.8% and the NASDAQ is -27.9%. Quite the nice bounce of the lows, but far out of bull market territory, in our opinion.

Moving Forward – The Economy and Opportunity

There is a lot of hand wringing and data manipulation on both sides of the political isle that try to take the word “recession” out of the current vernacular. To us, there is little utility in arguing over a label when the markets are pricing in what that label represents.

As of October 2022, household debt increased to $16.5 Trillion, a 15% year-over-year increase. This is not the sign of a healthy economy. 72% of annual U.S. GDP is driven by consumer spending.

While asset prices have come down, this has done little to narrow the wealth gap in the United States, as inflation has disproportionality impacted the largest group of Americans–the lower and middle class.

The average American lives paycheck to paycheck and is forced to cut back to pay grocery bills and fill the gas tank. The increase in household debt is attributed mostly to these two items going on credit cards as bills increase and wages do not keep pace. The housing market appears to be under stress too, and this will affect everyone.

Perspective

Historically, the average mild recession is met with an approximately -30% decline in the equity markets. As of the lows this year, those losses were already felt across many sectors and the broader market had dropped almost all the way there.

The consensus amongst market participants is that a recession is unavoidable. We believe this to be a long way towards already being fully priced in.

Fed funds futures are currently pricing in a near 5% Fed funds rate in June 2023. This is in keeping with the Fed’s statements. We do, however, believe that the Fed will begin to moderate the pace of its rate hikes as soon as their December 2022 meeting, and that the recent market bounce is a relief rally due to this realization.

Compound that with inflation heading back down and we could paint a picture where the dollar stabilizes and softens over the next 18 months.

This could make way for bond investors to reenter the fixed income markets, recapture liquidity-led losses in fixed income portfolios and for selling pressures to abate on equities.

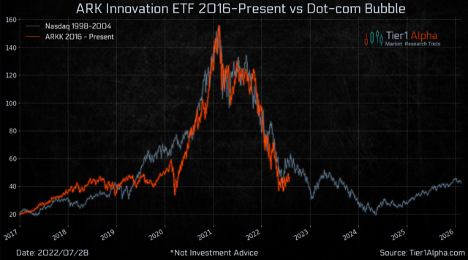

We often look for historical parallels to draw upon when evaluating markets; we keep finding similarities to the dot com crash in 1999-2000 when we look at today’s market.

No one chart illustrates these similarities like the one below, which overlays Cathie Wood’s ARKK fund’s rise and subsequent fall in this cycle with the dot com bubble from two decades ago.

History is never the same, but it often rhymes.

We believe there are more similarities to the dot com market today than just the fall of the tech sector. Just like in 2000, the rise and dominance of one sector has led to underinvestment in vast swaths of the broader market, particularly companies that are priced correctly based on fundamentals and that have a durable balance sheet and predictable cash flows.

Many forget, but in 2000 when the NASDAQ lost -39.2%, the Russell 1000 Value was up 7.4%. Value stocks were trading at single digit multiples and attracted capital that was fleeing the tech sector.

We find ourselves in the same situation now. Many companies that are profitable and have good balance sheets are now trading at single digit price earnings multiples. We too are focusing on moving capital to these areas.

There is potential for the market to bifurcate again, where underinvested companies with good fundamentals do well on a relative basis, at a time when the top-heavy broader indexes do not.

Keeping with this theme, the CWA Investment Committee just onboarded a new manager and directed capital there to take advantage of this possibility. Markets redirecting capital to these types of investments should be a tail wind for our portfolios going forward.

One of the benefits of market volatility are opportunities like the above. For the first time in many years, our opportunity set to buy assets at good prices has expanded and continues to do so.

The CWA Investment Committee has many opportunities in front of us that fit our valuation criteria that were not available even eight months ago. Our focus has shifted to evaluating these opportunities and deploying capital into those that we feel offer the best risk/reward potential.

As we enter 2023, our advisors do so with this mindset looking to take advantage of opportunities.

We believe we can make investments now with much more predictable return streams for the next five years than were available at the beginning of 2022. We also believe investors can become constructive on the fixed income markets again, as yields now represent return potential that was far gone a short ten months ago.

With an eye towards maximizing future returns, 2023 represents a year of possibility, not one of trepidation or fear of the unknown.

Cain Watters & Associates LLC (“CWA”) is a Registered Investment Advisor. Request our Form ADV Part 2A for a complete description of CWA’s investment advisory services. Diversification does not ensure a profit and may not protect against loss in declining markets. No inference should be drawn that managed accounts will be profitable in the future or that the Manager will be able to achieve its objectives. Investing involves risk and the possibility of loss, including a permanent loss of principal.

Past performance does not indicate future returns.

Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. All investments and strategies have the potential for profit or loss. Different types of investments involve higher and lower levels of risk. Historical performance returns for investment indexes and/or categories usually do not deduct transaction and/or custodial charges or an advisory fee, which would decrease historical performance results. There are no assurances that a portfolio will match or exceed any specific benchmark.

This commentary contains the opinions of the CWA Investment Committee at the time of publication and is subject to change. Market and economic factors can change rapidly, producing materially different results. This is not intended to be personalized investment advice. This does not take into account a particular investor’s financial objectives or risk tolerances. Any specific mention of securities is for informational purposes only and is not intended as a recommendation or solicitation to purchase or sell.

Use of Comparison Benchmark or Index: Indexes cannot be invested in directly. Index performance and statistics are provided for illustrative or comparison purposes and are chosen as commonly accepted representations of the performance of a particular segment of the market.