Why 2023’s market may have given investors a false sense of security

Brad Sanders

CFA, Tectonic Advisors

Written: Dec. 5, 2023

What a difference a year makes. After 2022 experienced double-digit declines in equity and bond markets, risk appetites returned in 2023 despite an ever-increasing backdrop of economic and geopolitical uncertainty. As of Nov. 30, 2023, the S&P 500 Index is up 20.8% YTD, while the bond market is up 1.6%.

Although on the surface, a 20% increase in the S&P 500 appears more than robust, the equity market has some “masking effects” to it this year. While we remain constructive on the broader market in general and more than constructive on fixed-income markets going forward, we believe that investors need to approach 2024 with eyes open and alert.

Let us go through the state of the equity, fixed income and private markets as we close out 2023.

The Magnificent 7 Drives the Equity Market

On a surface level, market returns in 2023 would likely cause a casual observer to posit that markets have just snapped back from 2022 and recovered losses broadly – not unlike how markets tend to react after large declines.

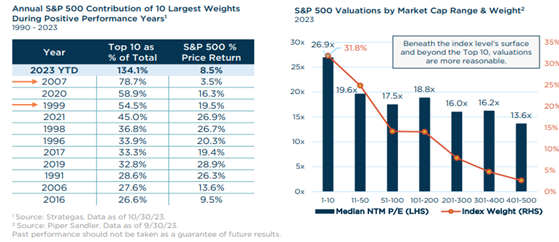

This, however, is not the case in 2023. In fact, as of the end of the third quarter, the top 10 names in the S&P 500 accounted for 134% of the market’s return year-to-date. In other words, if you take the top 10 performing companies in the S&P 500 out of the index, the other 490 stocks were negative for the year.

Nearly all of the 134% return can be attributed to seven technology names – Apple, Microsoft, Meta, Google, Tesla, NVIDIA and Amazon. Dubbed ‘the magnificent 7,’ these stocks have seemingly defied gravity and have seen multiple expansions even in the face of higher for longer rates and sticky inflation – two conditions that in general, do not favor technology stocks.

We have seen top-heavy markets before, most recently during the dot com bubble in the 1999-2001 timeframe, and we can draw many parallels between that market and today’s environment.

In 2000-2001, internet stocks – much like the ‘magnificent 7’ today – were very richly valued. However, the rest of the market was reasonably priced, again, much like today.

Typically, when you have one part of the market that is so richly valued, future returns for that sector are muted because valuations need to be rationalized at some point.

We often use history as our guide – particularly when there are this many parallels – in evaluating markets and making decisions. Much like 1999-2001, we have seen small- and mid-cap stocks hit record lows in terms of relative valuations to mega-cap stocks. This is highly informative since the last time this happened, the dotcom crash saw small- and mid-caps return 41% cumulatively and 63% cumulatively, respectively, over the next decade. Versus a near -10% cumulative return for the S&P 500. We have thus used the strength of the S&P 500 this year to reposition portfolios with weight to smaller and mid-cap companies.

These situations are generally resolved by capital seeking more reasonably valued companies with comparable or better growth rates, and we feel the majority of these can be found in small- and mid-caps. After all, 70% growth of annual U.S. GDP can be attributed to small- and medium-sized businesses – it seems more than reasonable that capital will be redeployed there in the future.

The Fed and the Fixed Income Market

It has been a wild 23 months for fixed income. After 2022, the fixed-income markets had to withstand further Fed rate hikes in 2023 (albeit at a more measured pace). Then in March, the Silicon Valley Bank (SVB) debacle caused bond markets to revolt, pricing in several rate cuts through the end of 2023, culminating in a projected 3.75% Fed Funds rate by year’s end, rather than the 5.25% it stands at today.

We were vocal in pointing out that SVB was not a 2008 scenario, but the market took the ball and ran. Fast forward to late summer and early fall, the bond market once again fell broadly as rate cut expectations had to be unwound.

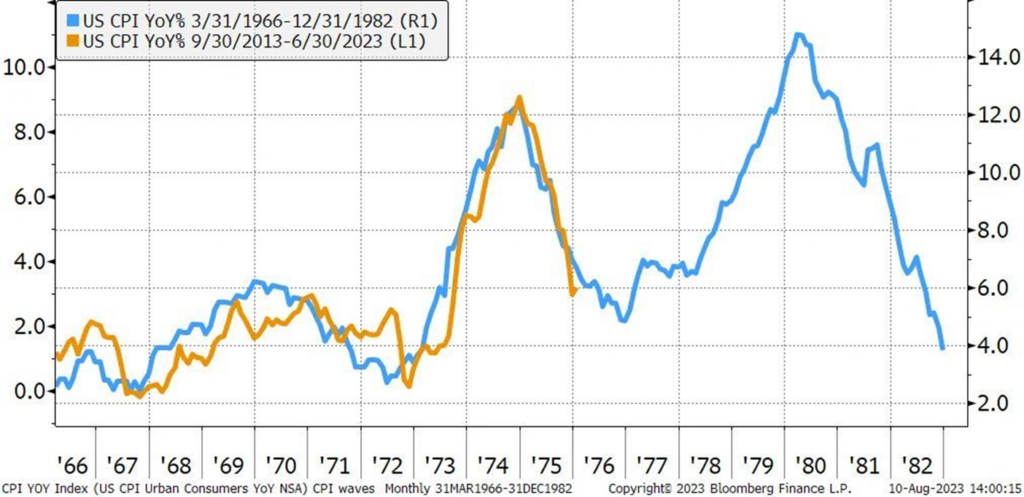

We have been stating since late last year that the Fed would pause rate hikes at some point but would then keep them elevated for as long as possible to make sure they keep their boot firmly on the neck of inflation. The Fed is not an entity that likes to make the same mistake twice, and they very clearly learned their lesson from the 1966-1980 period in which they eased too early and kicked off a secondary wave of inflation.

We expected the bond market to have an extreme snapback at some point; our reasoning behind this was that, observably, all of the lower moves have been attributed to interest rate movements – without a subsequent move higher in credit spreads.

Generally, when you have bond market losses of this magnitude, there has been a precipitating/causal credit crisis, which has been notably absent this time. We got a glimpse of this in November – the 10-Year Treasury yield fell from 4.8% to 4.2% in four weeks, and long-bonds rallied 10%. Any subsequent move lower in yields will likely be met with similar upside potential if credit conditions remain this sanguine.

We have not been this constructive on fixed income as an asset class in 20 years. The entry yield in fixed income alone now furthers the ability for clients to meet/exceed their financial plans in a way that has been unavailable under zero interest rate policy.

Furthermore, several fixed-income asset classes are more attractively priced than we have seen in our careers. Rarely have we seen opportunities like this in fixed income, and we encourage investors to think more long-term about the bond market rather than dwell on what has happened recently.

Private Markets

Higher rates have created tighter lending conditions, and fewer banks are willing to finance small and medium-sized businesses. Generally, with higher interest rates, one would expect private markets to slow down – however, due to the liquidity backdrop in the banking sector, the private market landscape remains robust.

The tremendous amount of capital raised in private markets in 2021-2022 needs to be put to work. The higher interest rate environment means that there are fewer deals available. So now we have a growing capital pile chasing a more limited opportunity set. Thus, many deals are getting done at terms that are not as favorable as they should be with a 5.25% federal funds rate, and many debt deals are going off normal loan conditions as investors scramble to invest capital.

As long as these pitfalls can be avoided, an investor can expect robust returns and an ever-growing opportunity set of new managers and strategies in the private markets. Additionally, manager selection is crucial to avoid some of the “known knowns” in the private marketplace – namely, the commercial real estate debt wall looming in 2024.

2024 and Beyond

While we look optimistically toward 2024, we need to be mindful that most economic data still points to a recessionary environment. This go around, if it materializes, it appears we may have a main street recession, rather than a Wall Street led recession.

We have geopolitical instability and a debt situation in the U.S. that is front and center, particularly as rates stay elevated. 2024 is also an election year, one that promises to be tense.

Given the market backdrop, we are highly risk-conscious in this environment and continue to navigate portfolios into areas that are less susceptible to macro events and have robust fundamentals if we move to a recessionary period.

However, given the valuations of large swaths of the market and the attractiveness of the fixed-income market, we find ourselves entering 2024 with a largely constructive and healthy outlook for risk assets, even in the face of elevated uncertainty.