Are you getting the most out of your financials?

Key Takeaways

- Monthly reports identify trends that must be addressed before they affect the bottom line.

- Reports featuring industry data help doctors set better benchmarks for success.

- Practice owners need to be able to translate their financials into actionable insights.

Warren Buffett once said, “Accounting is the language of business.” Unfortunately for dental practice owners, there is no Babbel to teach them how to speak fluent CFO. It’s a skill acquired while on the job, between patients, on nights and weekends.

While owner-doctors do an incredible job self-learning the basics of business strategies, CPA and CWA Partner Eric Jacobsmeyer says few owners are getting the full financial picture from their accounting reports.

“It comes down to two things … making sure doctors are receiving timely, accurate reporting and then understanding how to translate that reporting into smart business decisions.”

TIMELY, ACCURATE REPORTING IS KEY

Private dental practices typically fall into two categories when it comes to accounting: those with a CPA running their books and filing their taxes and those with an employee (e.g., office manager) tracking financials while a tax professional adjusts those financials so that a tax return can be prepared.

“Most CPAs focus on creating income statements and balance sheets, which is a good start,” says Eric. “But how often is the doctor reviewing those and, more importantly, does the doctor understand what the reports are saying?”

Monthly reporting is key to pinpointing trends that need to be addressed before they start affecting the bottom line.

“Waiting until the end of a quarter or during tax time to review financials is often too late to turn the tide,” says Eric.

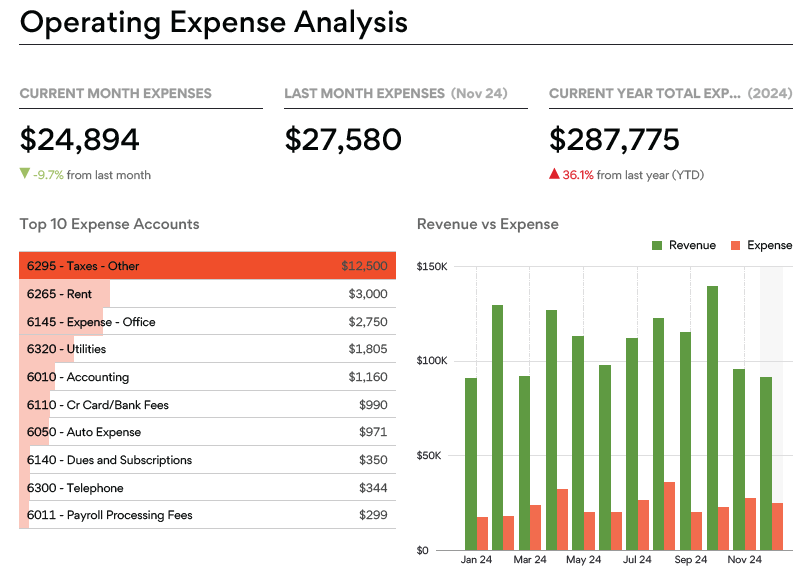

The depth and breadth of the reporting can make a significant difference as well. For example, are your financials giving you detailed revenue and expense analysis?

What about custom targets based on like-size practices across the industry?

According to Eric, reports featuring industry data provide a more comprehensive snapshot of how a practice should perform versus its competition and helps the doctor set better benchmarks for success.

See What This Can Look Like for You

Download a free sample KPI report to see an example of the insight our accounting can bring to your business.

The Importance of Setting Target Key Performance Indicators

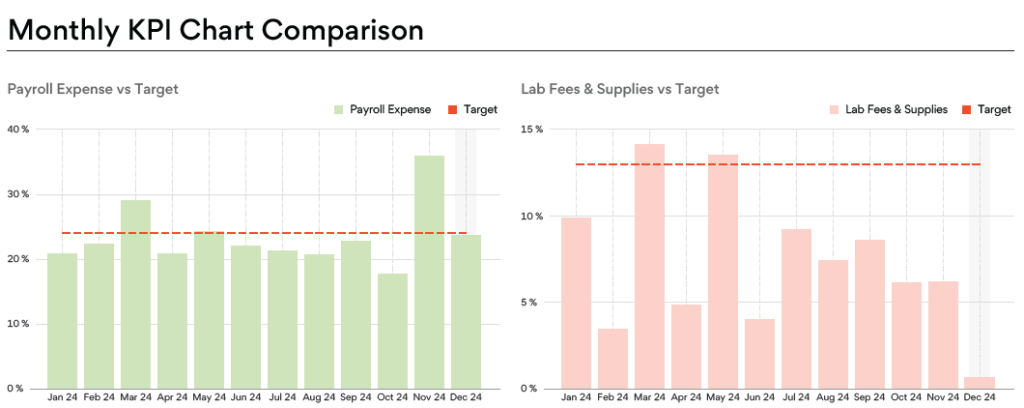

No two small businesses are alike, especially within the dental industry. Working with your CPA to identify areas to target and setting clear annual goals is critical to driving sustainable growth.

Whether it’s increasing collections, lowering payroll, or curbing overhead, being in lockstep with your CPA on the key performance indicators (KPI) specific to your practice keeps all parties aware of—and accountable for—reaching those targets.

“Setting clear goals is the first step in empowering your business to reach them,” says Eric. “A good accountant will keep business owners honest by beating that drum all year long.”

In addition to a meeting at the beginning of the year to review prior year financials and set targets for the current year, Eric meets with clients for a tax planning meeting around August-October to ensure the practice is on track toward achieving its goals.

“The Q3 meeting is critical as we explore ways to improve our tax situation,” says Eric. “We also review our goals and determine what adjustments we can make in these last three to four months to get there.”

TRANSLATING ACCOUNTING INTO ACTION

According to Eric, the last piece of the puzzle is education—arming practice owners with the knowledge to translate their financials into actionable insights. This is where Eric believes a good CPA can turn into a great business partner.

“Every metric tells a story. Helping business owners learn to make decisions based on what those numbers are saying is what we do here at CWA,” says Eric.

For example, it’s always a good idea to monitor overhead. But understanding why it’s trending up or down is where a doctor turns into a businessperson. Did merchant fees increase? Is there a one-time travel expense? Did the office upgrade computers or software?

“Understanding the nuances behind the numbers is key to deciding whether it’s time to take action,” says Eric.

Payroll is another metric that warrants deeper evaluation, as it requires a longer runway to make changes.

“When labor costs creep up, the first impulse is to let someone go,” says Eric. “While that may be the right move eventually, it’s always best to proceed strategically, evaluating trends and growth while also avoiding disruptions to business operations.”

Eric adds that having a CPA service willing to provide that industry-specific advisory element can be a game changer.

“Practice owners need a good accountant to provide timely and accurate financials, but a dental-specific tax advisor who understands the dental industry can educate and advise on those financial numbers plus help optimize taxes and minimize surprises,” says Eric. “Having the tax and accounting all under one roof provides some major advantages to a practice owner.”

To get a sneak peek at one of CWA’s comprehensive reports, check out the Monthly Performance Report.