The reasoning behind the desire to retire is unique. Some will want to retire because they no longer enjoy the day-to-day work that they do. Others will look forward to retirement because they are ready to get started on that “bucket list.” Then still, there is a group whom will want to retire because they attained a certain age where they think they should retire.

CWA has worked with professionals for over 30 years on reaching their retirement goals. What has become very clear over three decades of retirement planning is that most people focus on the financial aspects, but give very little thought to the psychology of actually retiring. This is a critical aspect of planning for the future that many people ignore.

Think about it:

How will you spend your time? What do your day-to-day activities look like when you no longer go into the office? I feel strongly that the risk of becoming lonely, bored, or losing a sense of purpose far outweighs the concern over whether you have enough money to retire. Being prepared for retirement seems to be twice as much psychological as it is financial.

When working with new clients, usually early in their career, we project their ‘ideal’ retirement age. The journey to that age is filled with saving, and for some, counting the days. But this arbitrary age, set as a retirement goal 30 years prior, might not actualize when they blow out the candles for a variety of reasons.

Three reasons people continue to work even if they financially don’t have to:

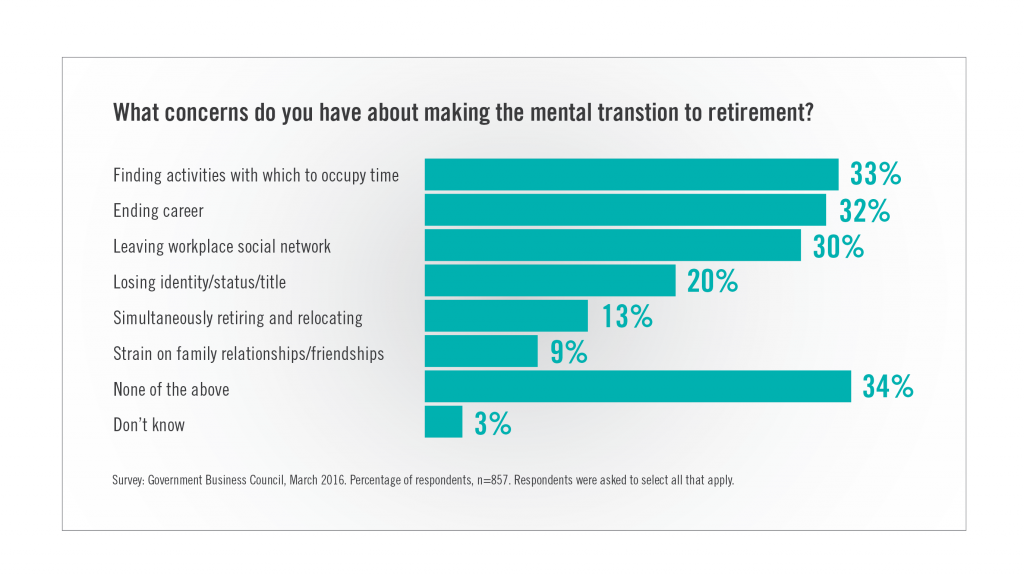

1. Social – Most individuals are part of a team in the workplace. Seeing familiar faces each day can be very rewarding, and help them feel a part of something larger than just themselves. Day in and day out of our careers, others depend upon us to do our part in order for the larger, team goals to be attained. Reaching these team goals is extremely satisfying to each member of the team, and drives us to want to attain even greater accomplishments with our teammates. When the decision is made to retire, how will that sense of belonging be replaced?

2. Leadership – Most business owners are looked up to, and called “the boss” in the workplace. When questions come up, the team looks to the owner for a resolution. While this demand can be frustrating at times, there is also an overwhelming sense of being needed by others that drives certain people. This sense of being “needed” often goes away in retirement, and that feeling can be hard to replace.

3. Professionalism – Much like our CWA clients, many individuals are skilled professionals that must stay focused in order to reach the level of business success they have attained. These professionals thrive on learning new methods and techniques. They often seek out new types of Continuing Education (CE) to improve their technical skills, or the advice of consultants to guide them in becoming better business leaders. Upon retirement, some of these professionals miss the drive to stay current, to stay sharp.

People have been advised to think that the financial ability to retire is the most important factor in determining when you should stop working. As a result, they are driven by the “could” rather than the “should.” People feel forced to stop working when they reach a certain age, or amass a certain amount of wealth. But neither age, level of wealth, nor any other factor should dictate the ultimate decision to retire. Only you can know when you’re truly ready to move to the next season in your life.

Make it a new beginning

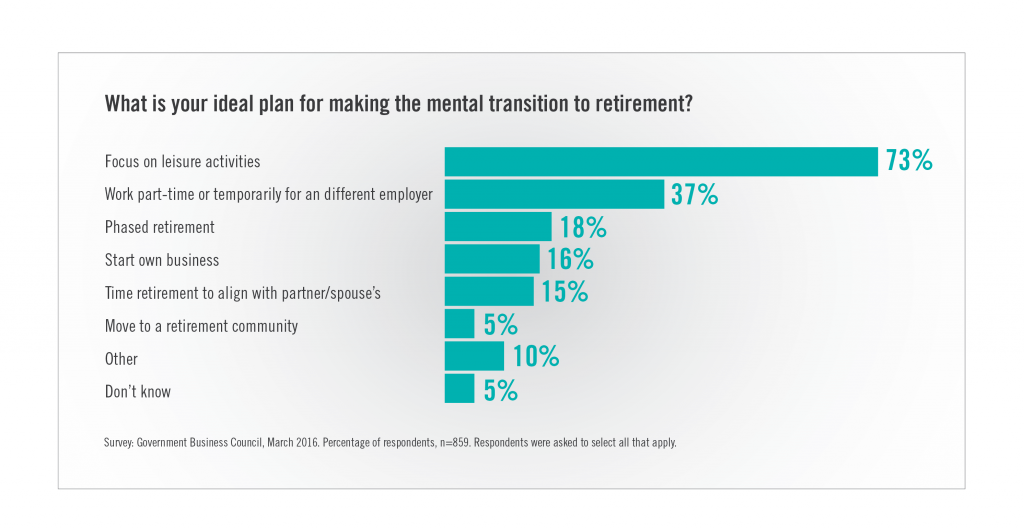

This next phase, also known as retirement, is rarely what we expect it to be once we arrive. Today people are not only living longer, but also have more active lifestyles during their retirement years. Of course we all have the anticipation and excitement to slow down and relax beachside, but it can also be an opportunity to explore that interest that you’ve never had the time to pursue. In this day and age, people often enjoy forming a new routine, and beginning new careers that are frequently unrelated to their pre-retirement work.

– Living Longer – Our experience has shown that most of our clients retire in their early to mid-60s. This is confirmed by the Social Security Administration who show the average age of retirement between 63 and 64. However, according to a USA Today study (April 2017), one out of four 65 year olds will live past the age of 90. The Social Security Administration supports these statistics, and show that close to 30% of 50-year-old women will live past 90. Because of these trends, it is prudent for you to plan on a retirement that can last 30 years or more.

– Spending More Money – According to the Employee Benefit Research Institute, 46% of retirees actually spend more in the first two years of their retirement than they did before they retired. Further, approximately 20% of retirees (that is one in every five) are still spending at a higher rate 6 years into their retirement. CWA advisors have also seen this steady pattern of increased spending, especially in the first 10 years of retirement. Often, clients think that their spending will go down once their debts have been paid off, or once the kids have finished college. But, you should always remember that your list of wants continues to grow, no matter how old you may be.

– Finding Your New ‘Normal’ – Most of you have gone to work each morning for the past 30+ years. You typically wake up at the same time every day, go through the same routine of getting ready, driving to work, and seeing the same people. Many of you have demanding schedules that keep you busy throughout the day as well. However, during retirement, there is a sense of lost structure. It is hard to imagine today, not enjoying excess spare time, however, excess time is a major area of concern for retirees. Establishing new routines can bring back the desire for productivity and increase the feeling of happiness and well-being.

All of these reasons are why many retirees have made the decision to continue to work in some capacity, even when they don’t have to do so financially. A recent survey by Time Magazine shows that over one-third of retirees plan to go back to work during retirement, at least on a part-time basis. The main reasons included staying current, and having a way to spend their time during each day.

Working towards well being

For years now, many of you have been looking forward to the time when you can do whatever you want to do, whenever you want to do it. It sounds so appealing to those of us who have worked so hard during our careers—but is your psychological portfolio as ready as your financial one?

Our advice to you is to find what your passions are, and follow them. Ease into it. If you enjoy what you are currently doing and are capable of doing it, consider why you would decide to stop now.

Maybe the better answer is to simply slow down a little. If you have other dreams in mind, you should pursue them. Become a classic car enthusiast, take up teaching, or take that trip overseas to explore your origin and ancestry. Whatever it may be, it’s important to always feel like you are striving towards a goal that helps give you a sense of purpose. And that goal isn’t always a financial one.