This is an except from the CWA monthly market update. To view the report in full, click here.

John Maynard Keynes, the famous British economist who is responsible for Keynesian economics and its various offshoots, used the term “animal spirits” in his 1936 publication “The General Theory of Employment, Interest and Money.” This term was used to describe the human emotion that drives consumer confidence and investor behavior.

In 2017, animal spirits were alive and well. The S&P 500 recorded a 21.8% gain, despite beginning the year with the third highest valuation metric on record (as measured by the Shiller PE Ratio**). The S&P 500 also recorded a gain in every month of the year which was the first time this has happened in recorded history, which is remarkable. International equities outpaced the U.S., posting a 24.6% gain as measured by the MSCI World Index.

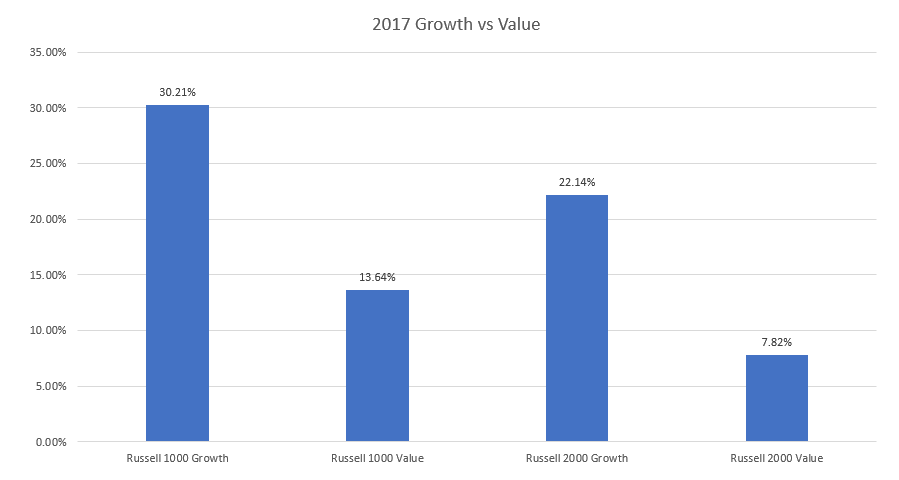

2017 was also a year in which Growth outperformed Value by a significant amount. However, these trends are historically mean reverting, and Value has outperformed Growth by 1.9% per year since 1926 (as measured by Fama and French, see disclosures+). We saw a similar period in 2015-2016, in which value underperformed, only to outperform the subsequent year.

Bond returns in the U.S. were 3.54% versus 7.39% for international bonds. Despite a year in which growth expectations were ratcheted up and the Fed raised rates several times, the 10-year U.S. Treasury ended with roughly the same yield as it began the year. The curve has been flattening, with longer-term Treasuries rallying. This typically signifies muted long-term inflation expectations, as well as the potential for a slowdown due to debt dynamics in the next 18-24 months.

The new tax reform bill was passed in the 4th quarter, and it served to give a boost to an already ebullient stock market. Stocks began a “melt up” pattern after it became clear we were on the doorstep of passing the reform. This melt up was characterized by historically low volatility and an appetite for risk that hasn’t been witnessed since the late 1990s. The tax reform bill should help corporate earnings in 2018, thus lowering current multiples and giving stocks the potential to run back up to current P/E valuation levels. There is also the potential for companies to repatriate capital (money held in foreign accounts by U.S. based companies) and there is a belief that this could lead to higher corporate spending and share repurchases – both of which are near term bullish for the market.

The tax cut will likely also cause the trade deficit to rise – some estimate by as much as $1.8 trillion. This is also short-term bullish for the markets. Longer-term remains to be seen, however historically running lofty trade deficits has worked against growth and has led to recessions.

The majority of the above comments are bullish, and the start of 2018 has seen the animal spirits continue. However, coupled with tax reform and market euphoria, the U.S. is entering what could prove to be a very volatile geopolitical environment. This past Tuesday, President Trump issued a tweet in which he bragged that the U.S. nuclear button is “bigger and works” as compared to the North Korean one. The market shrugged this comment off, but the comment is indicative of an environment that could lead to issues down the road. Tensions with Iran and European Brexit concerns are also alive and well, as are China’s issues with their currency and property bubbles (although it appears the market is granting China a temporary reprieve). The market historically does not price in idiosyncratic events very well, and thus any of the above is a threat to the market at any given time.

Additionally, the animal spirits awoke at a time when the market was the most expensive it has been since the technology bubble of 2000 and right before the Great Depression (as measured by the Shiller PE ratio). While this ratio is not predictive of short term market movements, it has been historically predictive of lower than average returns for equities over the next 10 years when valuations have reached these levels.

The geopolitical environment, combined with current market valuation levels, lead us to conclude that it is important to make sure sound risk management practices are in place. This does not mean that investors should sit on the sidelines – quite the contrary given the amount of good economic news on a global scale. It simply means that “keeping the eye on the ball” is paramount, and to not let animal spirits take over and get in the way of good judgement.

Further Reading

The Year American Hegemony Ended, Observer, December 31, 2017

This article outlines the current geopolitical environment and how tenuous the US’ hold as the global leader has become. This article describes a multitude of issues that we believe may impact markets over the near and intermediate term.

Energy Investors: Behold the Miracle of the Tax Law, Wall Street Journal, December 22, 2017

This article describes the favorable prospects to the energy industry from the new tax law.

DISCLOSURES

PAST PERFORMANCE IS NOT AN INDICATOR OF FUTURE MARKET RETURNS.

Cain Watters is a Registered Investment Advisor. Request Form ADV Part 2A for a complete description of Cain Watters Advisors’ investment advisory services. Diversification does not ensure a profit and may not protect against loss in declining markets. No inference should be drawn that managed accounts will be profitable in the future or that the Manager will be able to achieve its objectives. Investing involves risk and the possibility of loss, including a permanent loss of principal.

This commentary contains the opinions of the CWA Investment Committee at the time of publication and is subject to change. Market and economic factors can change rapidly, producing materially different results. This is not intended to be personalized investment advice. This does not take into account a particular investor’s financial objectives or risk tolerances. Any specific mention of securities is for informational purposes only and is not intended as a recommendation or solicitation to purchase.

**The CAPE ratio is a valuation measure that uses real earnings per share (EPS) over a 10-year period to smooth out fluctuations in corporate profits that occur over different periods of a business cycle. The ratio is generally applied to broad equity indices to assess whether the market is undervalued or overvalued. While the CAPE ratio is a popular and widely-followed measure, several leading industry practitioners have called into question its utility as a predictor of future stock market returns. The CAPE ratio, an acronym for Cyclically Adjusted P/E (i.e. Price-Earnings) ratio, was popularized by Yale University professor Robert Shiller. It is also known as the Shiller P/E ratio.

+Statements relating to Value outperforming Growth are based upon the data of the Fama-French 3-Factor Model. A pioneering study by renowned academics, Eugene Fama and Ken French, suggesting that three risk factors: market (beta), size (market capitalization) and price (book/market value) dimensions explain 96% of historical equity performance.

Use of Comparison Benchmark or Index: Indexes cannot be invested in directly. Index performance and statistics are provided for illustrative or comparison purposes and are chosen as commonly accepted representations of the performance of a particular segment of the market.