The College Board released college cost data for the 2017-2018 school year in its annual Trends in College Pricing report. Here are the highlights:

– Average cost of attending a public college for in-state students per year:

– Tuition and fees increased an average of 3.1% to $9,970

– Room and board increased an average of 3.1% to $10,800

*Total average cost for 2017-2018: $25,290 (up from $24,610 in 2016-2017)

Average cost of attending a public college for out-of-state students:

– Tuition and fees increased an average of 3.2% to $25,620

– Room and board increased an average of 3.1% to $10,800

*Total average cost for 2017-2018: $40,940 (up from $39,890 in 2016-2017)

Private colleges:

– Tuition and fees increased an average of 3.6% to $34,740

– Room and board increased an average of 3.0% to $12,210

*Total average cost for 2017-2018: $50,900 (up from $49,320 in 2016-2017)

* “Total average cost” includes direct billed costs for tuition, fees, room and board, plus a sum for books, transportation, and personal expenses, which will vary by student.

The road is paved with good intentions

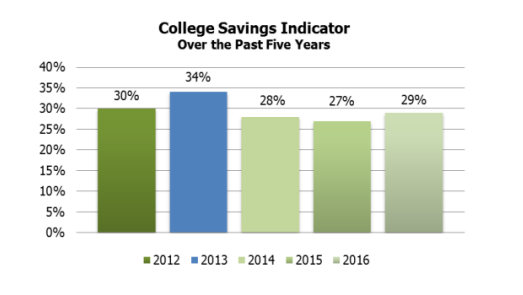

Fidelity Investment’s 10th Annual College Savings Indicator Study reports that although 70% of parents intend to cover the cost of tuition in full, they’re only on track to fulfill 29% of that goal by the time their children reach freshman year.

Although saving a portion is better than nothing, CWA Planner Scott Clynch encourages his clients to plan for the full cost.

“If a client has children, regardless of age, saving for college is usually a topic that comes up. Most people understand that time is money and incorporating savings into one’s financial plan early is key, but often times they are unsure as to how and where to start. By understanding the most tax efficient savings vehicles, combined with compounding interest and time to maturity – many are surprised at how obtainable the goal is,” says Scott.

If you still have sticker shock, consider that these estimates tend to be high. The College Board finds that the ‘net price’ at the average private college in 2017-18 was about $20,210 less than the published price. The difference can come from institutional grants, federal grants and tax benefits. It also does not take into account situations like commuter students, or those students who may contribute with a part-time job.

Where to Save

Most people choose to save in a college savings plan. Operating in a fashion similar to IRA and 401(k) plans, 529 college savings plans allow parents to save for a child’s education through a variety of investment options while potentially receiving a state tax deduction for all or a portion of their contributions.

What may be new news is that you can currently save in any state you want, taking advantage of the most beneficial tax environments. For some people, it can make sense to use your own state’s plan to take advantage of the tax deduction – but not all states offer tax deductions on contributions (notably California). Savingforcollege.com outlines state benefits clearly.

If the state doesn’t matter, the next things to look at are fees and performance. In some cases, better investment performance of another state’s plan (where earnings are compounded) can outweigh the benefits of a tax deduction.

While the 529 Plans offer an attractive savings environment, you could incur a 10% penalty for withdrawals not used for education.

Another place to save, with its own unique benefits is a Roth IRA. Most are familiar with a Roth IRA as a retirement account that you fund with post-tax income where both earnings and withdrawals after a certain age are tax-free. These types of accounts can also be used for higher education expenses without incurring the typical 10% early withdrawal penalty.

Roth IRAs must be funded with “earned income”, so you cannot just gift or contribute to this account on behalf of your child. However as the child gets older and starts earning income, either independently or through your practice payroll, a Roth IRA offers additional flexibility should college costs be less expensive than anticipated. Your financial planner should be able to guide you on how to set up a Roth IRA for your child.

Scott recommends a combination of both to his clients.

“The idea is to fund both a Roth IRA and a 529. You may look to intentionally underfund the 529 to ensure you have liquidated the account by the end of your child’s time in college. Then you would use the Roth IRA to cover the remainder.”

Other usages for excess funds

If you stay diligent in your savings, many clients wonder what will happen if you over save. Will you incur tax penalties by withdrawing money unrelated to higher education costs?

Let’s look at the Roth IRA first. If you do not use all of the Roth IRA for higher education, this type of account offers flexibility for alternative uses. One option is to leave it in there for your child to use at retirement, or up to $10,000 can even be used for a down payment or closing costs on the purchase of a first home.

And the 529? You could always use it for your grand-children, but now there is another option. The new tax law allows you to use your 529 plan savings in even more ways. Starting in 2018, it now allows $10,000 in annual tax-free 529 account withdrawals for pre-college (K-12) private school.

That’s not all, for those especially generous family members, these savings plans qualify for the gift-tax annual exclusion which is $15,000 per recipient in 2018 ($30,000 for benefactors who are married).

What percentage are you on track for? To ensure you are meeting your goals, consider reaching out at cainwatters.com/contact.