As a business owner, you are very familiar with submitting W-2s for any employees that were employed and paid either hourly or salary over the past calendar year. But what about other contractors that performed consistent services for you over the year?

A perfect example of an independent contractor is a cleaning service. The service comes into your office to do work, but the cleaning service workers are not employees of your company. Other examples may be your CPA, attorney, IT or maintenance company—even your supplies buyer club.

Did you know you may need to file a tax form for them too?

KNOW THE RULE:

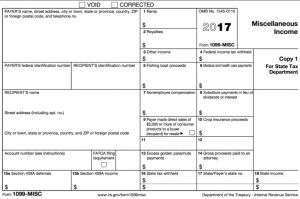

According to the IRS, if you pay independent contractors, you may have to file a Form 1099-MISC to report payments for services performed for your trade or business. Businesses are required to issue a 1099-MISC form to any vendor from which they bought or leased goods, equipment, land or paid-for services at least $600 last year. This threshold can be met from any single transaction or based on the total amount of payments for the year.

The IRS Form 1099-MISC summarizes income from all non-employee compensation. It’s what independent contractors use to calculate and file taxes.

If the following four conditions are met, you must generally report a payment as non-employee compensation:

1. You made the payment to someone who is not your employee;

2. You made the payment for services in the course of your trade or business (including government agencies and nonprofit organizations);

3. You made the payment to an individual, partnership, estate, or in some cases, a corporation; and

4. You made payments to the payee of at least $600 during the year.

KNOW WHO YOU ARE PAYING:

There are a few exceptions to this rule: You do not have to send 1099s to most corporations (note: you must send 1099s to all lawyers you’ve hired, even if they’re incorporated), property managers for rent, sellers of merchandise, etc. See this article for a full list of exemptions.

HOW YOU PAY CAN MAKE THE DIFFERENCE:

If you pay by check, you need to file a 1099-MISC form, but if you pay by credit card, then the credit card companies are responsible for doing that.

DEADLINE:

The deadline to submit 1099-MISC forms for the previous calendar year is January 31.

WHAT IF YOU DON’T:

The penalty for missing the deadline ranges from $30 to $100 per form, with a maximum fine of $500,000 per year. If a company completely disregards the requirement to provide a correct statement, it could be hit with a penalty of $250 per form, with no maximum.

Anyone can file a 1099, although it is easiest to electronically file them. Many accounting softwares have a 1099 filing function in them. It is common to have to pay a fee of some sort to file them, there are very few softwares (if any) that are free.