A guide for getting started

Saving for retirement, paying down debt, buying a home or building liquidity—when extra money is tight, where should your dollars go first?

At the beginning of a budding career, nothing seems farther away than retirement. It can be difficult to focus on saving for an event 40 years in the future, when today’s needs and desires seem much more urgent.

CWA Associate Planner Sarah Kelly Oliver has been there and knows that although opening that first investment retirement account is the hardest—it’s essential to start early, when time is your biggest ally.

“It’s not easy,” says Sarah. “Short-term goals, like paying off a student loan or making a down payment on a home, offer the reward of immediate positive emotions—while savings for retirement doesn’t instantaneously give that. What I like to put my focus on is the value of my dollar tomorrow. I’m able to find satisfaction in knowing that the dollar I’m saving today, will be worth five times that much to me later down the road.”

Compounding interest’s impact on today’s savings is the biggest asset young people have on their side. Let’s look at this example:

If you contribute $6,000 to an IRA every year ($500 per month) from age 25 to 65, this account could grow to almost $1.3 million (at a 7% growth rate). Of the total $1.3 million, $246,000 was contributed by you ($6,000 for 40 years) and over $1 million was returns generated based on the 7% growth rate. The earlier you start saving, the faster your money can take advantage of this compounding.

The Six Vital Categories to Save For

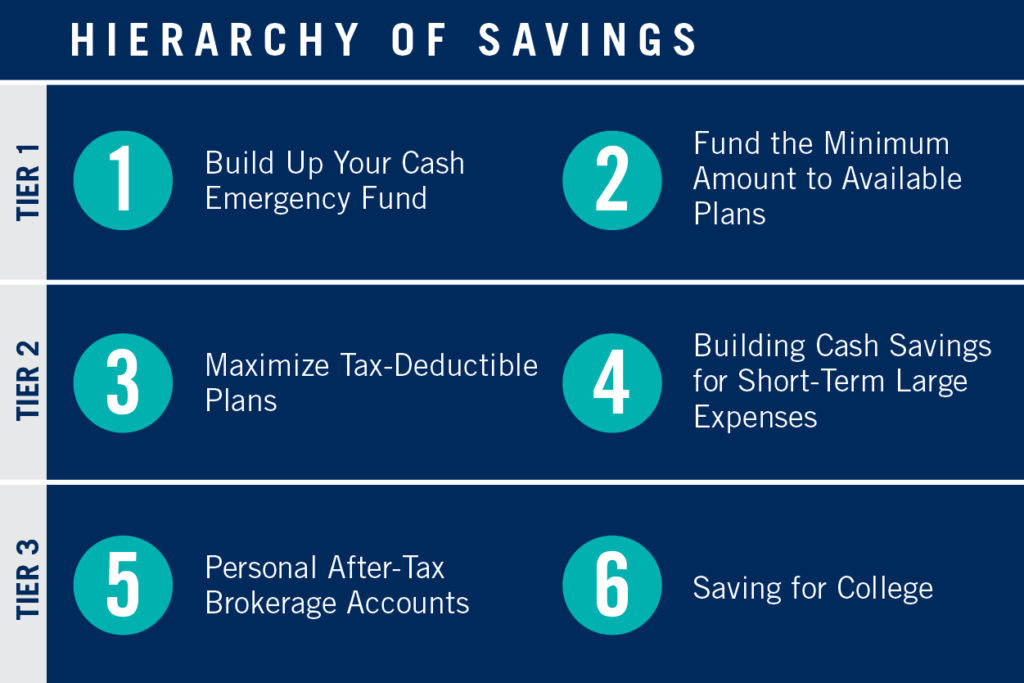

So where does one start when there are limited funds? When every goal is pulling you in different directions, Sarah likes to look at savings in six categories. She advises to start with the first two together as stage one, and roll into the other categories as you can.

1. Build Up Your Cash Emergency Fund

Emergencies and volatility can happen, and you need to be prepared. Sarah suggests having three to six months of basic living expenses set aside in a checking or savings account that can be easily accessed if needed.

Pro Tip

If it seems overwhelming to save this much, Sarah suggests building this cash balance out over one-to-two years. Find out what your living expenses are for 3-6 months, then divide that by 12 to 24 months. For example, if your basic living expenses are $4,000 per month, and $12,000 for three months, then if you saved $500 per month, you would reach your goal in two years.

2. Fund the Minimum Amount to Earn an Employer Match

If your employer offers a 401(k) matching plan, then not saving at least that amount would be throwing away free money. It’s okay to not to save the maximum allowed at this point, but with time on your side you need to start somewhere. Taking advantage of employer match 401(k) and HSA funds today, will make a huge impact tomorrow.

“An investment hierarchy is simply a recommended order of investment categories. For example, you should generally not invest in after-tax brokerage accounts before you have maximized the tax-advantaged plans available to you, and you should not aim to max out your retirement accounts before you have an emergency fund in place.”

3. Maximize Tax-Deductible Plans

Once you are comfortable with step one and two—it’s time to start working toward saving even more by maximizing your employers 401(k). If you employer does not offer one, there are other options like a SEP IRA, or an Individual Retirement Account (IRA) and Health Savings Accounts. Consider increasing your contribution by a few percentage points each year, or when you receive a raise. In 2020, the limit is $19,500 for those under 50, or $26,000 for those over 50 by the end of the calendar year.

4. Building Cash Savings for Short-Term Large Expenses

These are the unique savings accounts that are working toward those large expenses that you know are coming in the next five years, like a down-payment on a new home, new car, wedding or vacations. This should be kept separate from the emergency fund, because these are expected expenses.

5. Personal After-Tax Brokerage Accounts

Only after you have maximized the tax-advantaged vehicles like a 401(k) or IRA, should you start investing in a personal brokerage account for building wealth.

6. Saving for College

Once children come it’s natural to start thinking and wanting to save for their college education. Although it’s beneficial to start as early as you can, Sarah reminds that savings for a child’s college should not come at the expense of your own retirement. Students have options like federal or private loans and scholarships, but there is no replacement for retirement funds.

Where do debt payments like student loans fit in? Most experts will agree that while retirement is a long-term goal, debt should be seen as a short-term goal. Obviously minimum payments must be made against student loan debt. If it’s important to you to make additional payments, using dollars left over after step 1 and 2 is the best place to start.

Sarah’s quick tip: Automate your savings

“Create and name different savings accounts for different purposes. Within my banking portal I have three different savings accounts all with unique names to remind me what goal I’m working toward,” says Sarah. “Be it my future house, my next travel destination, student loans or my emergency savings fund—naming each one makes the progress toward my goals more real.”

With each account separate, it’s even easier to set up a reoccurring transfer of a set monthly dollar amount towards each account’s goals. Automating your monthly savings is a fool proof way to make progress, and with today’s advanced banking applications it can easily be set up in minutes. By keeping these dollars out of your checking account, you will naturally adjust your spending. With this set-it-and-forget-it mindset, you will be surprised how much you can save in a few years.

Just Get Started

Once you know what you make and what you spend on living expenses—this savings hierarchy offers a way of prioritizing the dollars you have left toward the most important goals. Start at the top and start making progress against your short and long-term goals.

Still have some questions? Our financial planners can create a custom plan to map out your goals. Contact us for a complimentary consultation.

Past performance is not an indicator of future results. Cain Watters is a Registered Investment Advisor. Cain Watters only conducts business in states where it is properly registered or is excluded from registration requirements. Registration is not an endorsement of the firm by securities regulators and does not mean the adviser has achieved a specific level of skill or ability. Request Form ADV Part 2A for a complete description of Cain Watters investment advisory services. Diversification does not ensure a profit and may not protect against loss in declining markets. No inference should be drawn that managed accounts will be profitable in the future or that the Manager will be able to achieve its objectives. All investments and strategies have the potential for profit or loss. Different types of investments involve higher and lower levels of risk. Historical performance returns for investment indexes and/or categories, usually do not deduct transaction and/or custodial charges or an advisory fee, which would decrease historical performance results. There are no assurances that an investor’s portfolio will match or exceed any specific benchmark. This is not intended to be personalized financial advice and is not a recommendation for any particular security or strategy.