A Letter from CWA Founder Darrell Cain

As we all navigate through these turbulent times, I’d like to take a step back and examine this moment with a wider lens. It’s my own, one that is based on the 35 years spent walking alongside my clients through several market cycles. This experience has gifted me perspective and taught me important lessons that I hope to share with all of you, many of which may be going through this for the first time. Above all, I want to convey my confidence that as bad as this moment seems, better times lay ahead.

The Lesson of the 1987 Crash: Don’t Miss the Recovery

Let me start with the Crash of 1987. I was 31 years old. There was no internet or online tools. CWA clients had their own brokerage accounts with stockbrokers (remember those?) all over the country in which we bought and sold stocks.

I educated my clients how to do fundamental stock analysis with paper insert books called Value Line. Many clients held a significant cash position as yields were much higher than they are today.

On the evening of the Black Monday crash, my only memories are returning home to my wife and two little boys and then at some point, curled on the bathroom floor, physically ill. Advising my clients on how to manage their hard-earned money was, and still is, very personal to me.

Lifting myself up from the bottom, I felt a call to action and started reaching out to brokers with whom I had built respect, and began asking their opinions. The older and wiser of them said, “Darrell go put the cash back into the market, everything is on sale!”

The next morning, I arrived at DFW Airport at 5 a.m. to buy a Wall Street Journal to see all the stock prices. I kept a book on all my clients’ brokerage statements and went through their positions. Starting on the East Coast, I made phone calls working my way through the time zones, giving my advice on what to buy and we put money to work.

Eventually, the market recovered, and stock prices rose again. After the market bottomed in December of 1987, the market recovered 23% in the next year and over 120% over the 3-year period.

This brought my first lesson. After every deep correction, the market finds a bottom and historically has recovered nicely, as evidenced by the following chart:

Source: A Wealth of Common Sense

Liquidating Stocks and Missing the Upside

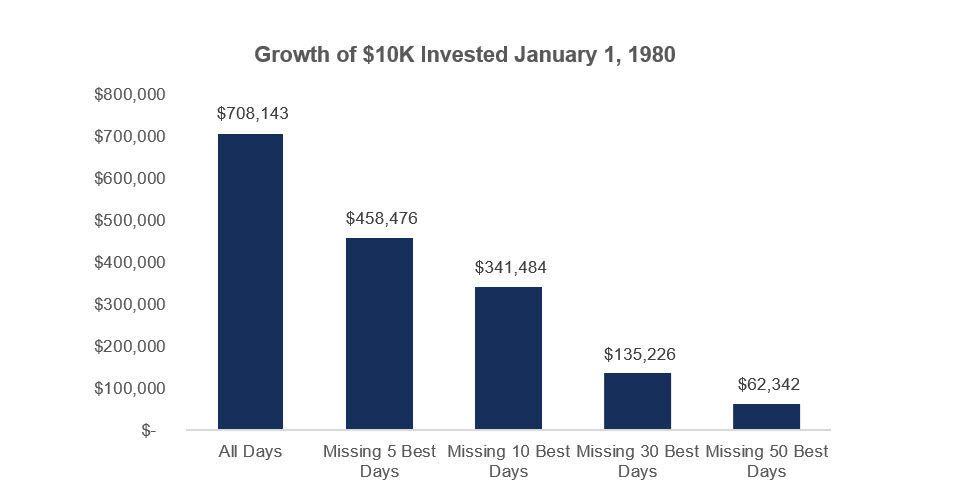

My second lesson was that you need to stay invested to participate in the recovery.

I learned this lesson the hard way, as I saw clients sell stocks during the crash then stay in cash too long and miss the recovery when the market came back.

Managing the behavioral impulses of the emotional buying and selling that can come from following the market’s ups and downs can feel impossible, which is why we trust our advisors to manage our portfolios during times of stress.

Fear of uncertainty taught us all an important lesson that year. Selling your investments and missing even a few days can be devastating, as the following chart illustrates:

Note: Returns are gross of taxes and fees.

Source: The Simple Dollar

Buying Low & Selling High Using Asset Allocation and Re-Balancing

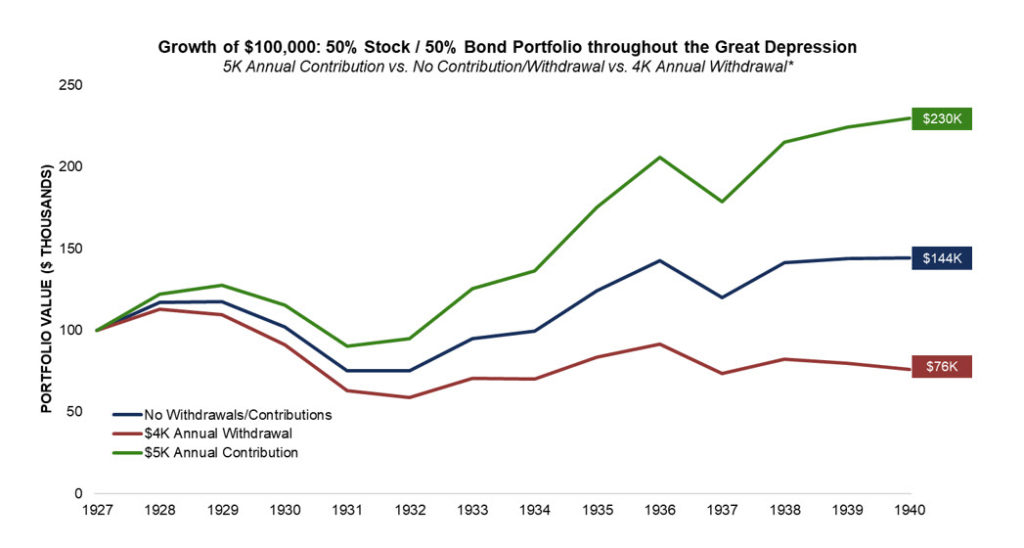

Today of course, we are much more sophisticated from an asset allocation perspective.

We do not carry as much cash. Instead, we have fixed income in most of our portfolios.

The CWA philosophy is to re-balance after a big decline in equities, by selling fixed income and buying equities to maintain our desired balance. This is the same philosophy, which is selling high (fixed income typically does reasonably well during big stock market declines) and buy equities (at a low valuation).

As the chart illustrates below, maintaining a balanced portfolio even during the Great Depression provided a durable portfolio—even for a retiree drawing on it for income!

Source: CWA/Tectonic Advisors

Applying the Lessons of 1987 to Today

The lessons learned in 1987 still apply to today’s circumstance:

- Asset allocation matters. Investing all in stocks destines you to risk significant downside. We call it the efficient frontier model, which calls for a mix of bonds and stocks in a portfolio. Measuring risk, even though it is an unforeseen event is important.

- Structure of your system matters. Calling 100 brokers was not a good system. However, it was the start of moving money to Pooled Funds that had dedicated professional managers that invested actively.

- Diversification is key, as it spreads risk out to several different asset classes and keeps you from having concentrated bets that can be severely impacted by economic shocks.

- Rebalancing decisions should be unemotional and based on data, not on fear.

- Do not panic. Every crisis is different, the world will change but economic activity can be measured, and value can be found. Keeping calm allows you to take advantage of the relief from the selling and to get your financial plan back on track much more quickly.

- Maintain your strategy and plan. Capitulation and selling everything can feel good, but for the long term it is very hard to put your money back to work. If you can sell and have enough money to live on the rest of your life, pulling cash out from under your bed to live on, then quit investing money. However, this is not the case for most of us, working or retired.

This financial crisis involves a large amount of uncertainty, and we could very well still have more downside ahead. We have been updating returns for our investment models regularly. Clients, please see our updated returns on our website which show how your model investment is doing. Our strategy and process is working as expected.

We have already completed a small rebalance in order to take some gains on the Fixed Income side and redeploy them into the stock market at depressed prices. We have other larger moves we can make as the situation may dictate. Be on the lookout for updates from Tectonic and the CWA Investment Committee that will detail these when the time comes.

If you are not a client and need some guidance, I invite you to join our community. These are unexpected times and we have diligently built an investment team with experts that can help you navigate this. In times of uncertainty and crisis, there is a premium on good investment advice steering us away from making decisions based on our own fears. We are here for you if you need us.

Sincerely,