Planning for salary & wages, healthcare and retirement funding during the 8-week forgiveness period

On April 27, the second round of Paycheck Protection Program (PPP) funding was released. A total of $310 billion was allocated and as of today, most CWA clients have either received or secured their SBA funds. With that, we wanted to readdress the qualified expenses and how to approach the 8-week qualified period.

Note: We are still awaiting further guidance on forgiveness. This was initially promised to be delivered on April 26, but has yet to be received. Our suggestions may change based on any new developments in the SBA final rule. This blog is our thoughts with the information we have as of April 30, 2020.

UNDERSTANDING THE QUALIFIED PERIOD

A borrower has 8-weeks from the receipt of the PPP funds to spend the proceeds on qualified expenses in order to achieve some level of forgiveness. For example, if a borrower received their funds on April 30, they would have until June 25, 2020 to spend the proceeds to obtain forgiveness. We recommend each client note their 8-week end date on their calendar.

Note: We do not expect that many borrowers will be able to spend all of their proceeds on qualified expenses during the 8-week period. This will leave an amount that is not forgivable. Borrowers can continue to use these PPP funds on qualified expenses after the 8-week period, but these amounts will need to be repaid.

75/25 RULE

Qualified salaries will be the primary driver of the forgivable amount. At least 75% of the forgivable amount will be salary related expenses (salary, health, pension) while the other qualified expenses of rent, utilities and interest on practice related debt is capped at 25%.

Example: If you have $60,000 in qualified salary expenses during the 8-week period, the amount of rent, utilities and interest would be capped at $20,000. Any additional amounts spent on these qualified expenses will need to be repaid.

SALARY & WAGES

Any wages paid to employees during this time will be included, but what is less clear is wages paid to owners and associates making over $100,000 and family salaries.

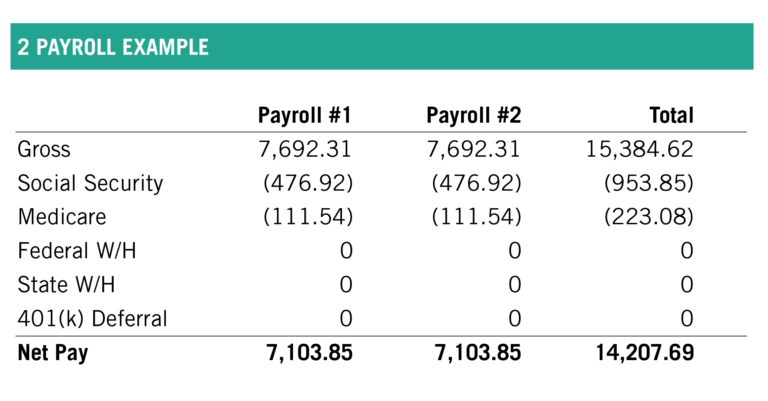

- DOCTORS & ASSOCIATES MAKING OVER $100,000: We believe that the correct amount to pay through wages during this 8-week period is $15,384.62 ($100,000/52 weeks X 8 weeks).

Here are examples of how to run payroll during your 8-week qualified period. Whether you are running two or four payrolls during the 8-week period, the following example is what is what you will want to report back to your payroll company.

Note: We have not included any federal tax withholding, state tax withholding or 401(K) deferrals in these examples. Talk to your advisor about your individual situation related to withholdings.

- FAMILY MEMBERS: For family members, wages should reflect the same amount of wages the family member received during the period before Feb. 15, 2020. We recommend you issue compensation, at a minimum, two times to reflect “monthly” compensation.

- Calculation: Example: 2019 salary of $20,000. 20,000/52 weeks X 8 weeks. This results in wages paid of $3,076.92. We recommend you issue compensation, at a minimum, two times to reflect “monthly” compensation.

- Documentation Needed: Copies of payroll processing reports, tax or other reports during the 8-week period (including related payments), including vacation, sick and other paid time off for all employees.

HEALTHCARE BENEFITS

If your practice has a group healthcare insurance plan, the premiums incurred and paid during your 8-week period are considered qualified expenses.

- GROUP PLANS: This Is a qualified and forgivable health care cost and does include owners.

- INDIVIDUAL HEALTH PLANS: We do not believe individual health plans for owners and their family will be a qualified expense.

- HEALTH SAVINGS ACCOUNTS: We do not believe Health Savings Account (HSA) contributions for the benefit of owners or their families will be a qualified expense.

Documentation Needed: Documentation reflecting the health insurance premiums paid by the company under a group healthcare plan including owners of the company during the 8-week period. Copies of the monthly invoices should suffice.

RETIREMENT PLAN FUNDING

Retirement plan contributions made during the 8-week qualified period are eligible PPP expenses. This includes employer contributions funded to Defined Benefit Plans, Defined Contribution Plans and SEP IRAs.

- RETIREMENT CONTRIBUTIONS: With lack of SBA guidance on the PPP forgiveness, it is unclear how much, if any, the owner and owner’s family benefits will be forgiven. We believe the amount of forgivable retirement contributions may be limited. We recommend that you make payments for the employer funding, at a minimum, two times to reflect average monthly contributions.

Documentation Needed: Documentation of retirement plan funding by the employer during the 8-week period following the origination of loan should be sufficient. Copies of statements, funding schedules and remittances to the retirement plan administrator should be available.

SUMMARY

These are the primary qualified salary expenses related to PPP. The other qualified expenses of rent, utilities and interest on practice related debt is capped at 25%.

Please read our blog on qualified expenses for details on rent, utilities, business loan interest and other non-payroll expenses.

As mentioned, we expect more guidance on both qualified expenses and forgiveness to be issued by the SBA soon. In the meantime, this outline allows business owners who have already received their PPP disbursements to begin to spend on qualified expenses and properly track.

To maximize your forgiveness, we cannot stress enough the need to gather expense information as you spend the money and have it available at the end of your 8-week period.

As always, CWA will keep you up to date with any additional guidance as soon as it is released. For all our updates, visit our resources page at cainwatters.com/covid-19.

We are here to help. We have supported dental professionals through all stages of their life, including previous market down turns. You don’t have to carry your life’s work on your shoulders alone. We are here to help. Our team is available to discuss your personal situation at any time.