COVID-19 strategies and IRS decisions could mean you owe more money than you think

The COVID-19 quarantine restrictions continue to evolve, affecting businesses in ways many of us couldn’t have imagined when the pandemic began in the U.S. back in March.

At the beginning of the year, business was looking promising for the majority of our clients nationwide—with 2020 projected to potentially be their best year yet. Quarantine brought that to a halt, although PPP funds and proactive planning have helped many business owners weather the storm. Though, those funds are starting to be exhausted by businesses, too.

Proactive planning included the decision by many dental practice owners to stop paying themselves from the practice. As a result, they also may have stopped withholding for federal and state taxes. This decision was a necessary option at the time as maintaining cash flow was essential due to the uncertainty the world presented. Some may have also received a deferment of rent and/or loan payments during this time.

With these strategies in place, some business owners find themselves in a better position than they expected they would be, given stimulus, strategic decision making and penny pinching.

Despite this good fortune, this may mean you are behind on your taxes this year.

WHY WOULD I BE BEHIND ON TAXES?

There are several reasons this may be the case in your situation, and we have outlined some of those below.

The most important thing you can do at this point is make sure you are working with your advisor to get an idea of where you stand regarding taxes, and enact an action plan for the second half of the year.

More importantly, it would be wise to not spend any of the cash you have built up on anything that is not completely necessary in the business or at home, until you have a clearly defined plan for the rest of 2020.

Some of the factors that may be causing you to be behind on your taxes:

- IRS ruling that payroll expenses (or other allowable expenses) you paid for with PPP stimulus money, will NOT be considered a deductible expense for your taxes this year.

- IRS ruling that the HHS stimulus funds will be considered taxable income to the business.

- Lower expenses during April and May, which resulted in less tax deductions. These could include dental supplies, office supplies, lab bills, advertising expenses, rent payments, staff salaries of furloughed employees, etc.

- Stopping your payroll and tax withholding from the business in the spring, and not starting back up again until recently.

- June may have been a high collection month for your business, compared to the previous months or even the previous June in 2019.

CASE STUDY: DETERMINING IF YOU ARE BEHIND ON TAXES

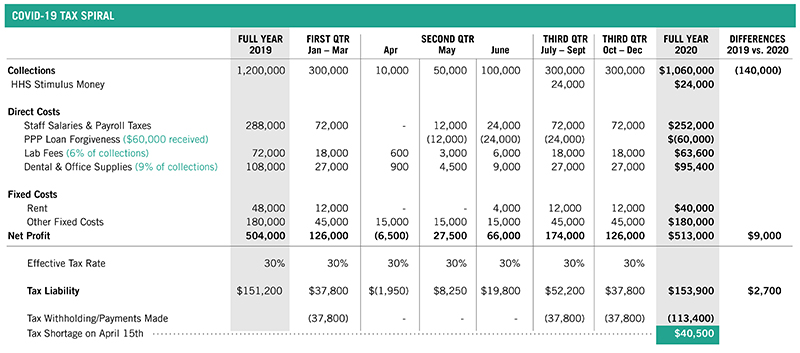

To explain this visually, we have included a case study of what a typical dental practice profit & loss statement might look like each quarter of 2020 compared to 2019. Here are the assumptions used in this case study:

- Average normal monthly collections of $100,000

- 10% of normal collections in April 2020

- 50% of normal collections in May 2020

- 100% of normal collections in June 2020

- Average normal monthly payroll costs of $24,000

- This assumes staff were furloughed April through mid-May before being brought back on payroll

- Rent was deferred for two months

- Set tax withholding was based on taxes in 2019, however, to conserve cash, no taxes were paid in during the second quarter

- Back to normal in the second half of the year

- Collections restored to $100,000 per month

- Staff payroll costs back to $24,000 per month

- Full rent payments restored

- Doctor payroll and tax withholding started back up

In this example, through the factors described earlier, the collections for 2020 are lower than 2019 by $140,000, but the taxable profit is up by $9,000. This has resulted in an increase in taxes of $2,700 in 2020 compared to 2019.

The result would be $40,500 in taxes owed at year end without the proper tax planning.

Without this knowledge, you risk using this built up cash elsewhere, resulting in being forced to use earnings in 2021 to pay taxes from 2020. This can create a never ending “chase your tail” situation known as the tax spiral.

We illustrate the concept of tax spiral in Doctor 1’s journey in the 2 Doctors in Debt example. View that here.

In your upcoming calls or annual consult, your CWA advisor will discuss this with you in depth; however, please reach out to your advisor with any questions.

Our advisors can help you navigate your financial liabilities through good times and bad.