Can you increase PPP forgiveness by leveraging the APCP?

For Paycheck Protection Program (PPP) borrowers, ensuring maximum forgiveness on their loan has been anything but straightforward. In our most recent CWA webinar explaining the PPP forgiveness application, notable highlights of the recently released forgiveness application were explained.

While the SBA’s form provided clarity on some topics, it introduced more questions and confusion around others. Notably, the application instructions introduced the new concept of an alternative payroll covered period (referred to as APCP) as a substitute payroll period, offering borrowers the choice to replace the normal 8-week covered period (CP).

HOW THE COVERED PERIOD DIFFERS FROM THE ALTERNATIVE PAYROLL COVERED PERIOD

The CP begins on the date the funds were received and ends 56 days after that date. While the APCP, if elected, begins on the first day of the first pay period following the disbursement of the PPP funds and ends 56 days after that date.

This new covered period provides a potential opportunity for small business owners to increase the PPP forgiveness associated with payroll-related costs, in particular, for businesses that remained closed after receipt of the PPP funds.

Employers that select the APCP must be on a bi-weekly or more frequent pay schedule or must switch to this level of frequency. Based on this guidance, the APCP would not apply to employers that use a semi-monthly payroll. A bi-weekly payroll pays your employees every two weeks and results in 26 pay dates a year, while a semi-monthly payroll pays employees twice per month (for example on the 15th and then final day of the month) and results in 24 pay dates.

If there is going to be a material impact on forgiveness, an employer should consider changing their payroll frequency in order to take advantage of the APCP. Keep in mind that it could be administratively burdensome to switch pay periods as many payroll deductions will also need to be adjusted.

It is important to note that the APCP is only available for payroll costs and does not change the CP for non-payroll qualified expenses (i.e. rent, utilities & interest).

Scenarios Illustrating the Application of the APCP

For purposes of explaining how the APCP may be relevant to your PPP forgiveness strategy, please see the following three illustrations.

For all three scenarios, the following assumptions apply:

- Annual Staff Payroll Cost: $351,000 ($13,500 average bi-weekly payroll)

- These scenarios only consider staff gross wages and does not consider retirement plan or health insurance benefits which could be added to this analysis for purposes of the APCP.

The scenarios consider different payroll frequencies and various re-open dates.

SCENARIO 1: BI-WEEKLY

Assume your business is already on a bi-weekly payroll schedule. You receive the PPP funds on May 4 and your normal pay period covers wages earned from May 2 through May 15. In this scenario, you re-opened your practice on May 18. Your default CP, without electing the APCP, would be May 4 through June 28. Your APCP would start on the 1st day of the next pay period after receipt of the PPP funds, which would be May 16.

Electing the APCP would allow you to start your forgiveness period at a later date, when you are utilizing your staff at a higher rate as a result of being reopen. For illustration purposes, we are assuming 40% staff utilization during the first pay period since the office is not yet open and 100% utilization in subsequent payroll periods. The result is an additional PPP forgiveness amount of $8,100 by electing to utilize the APCP.

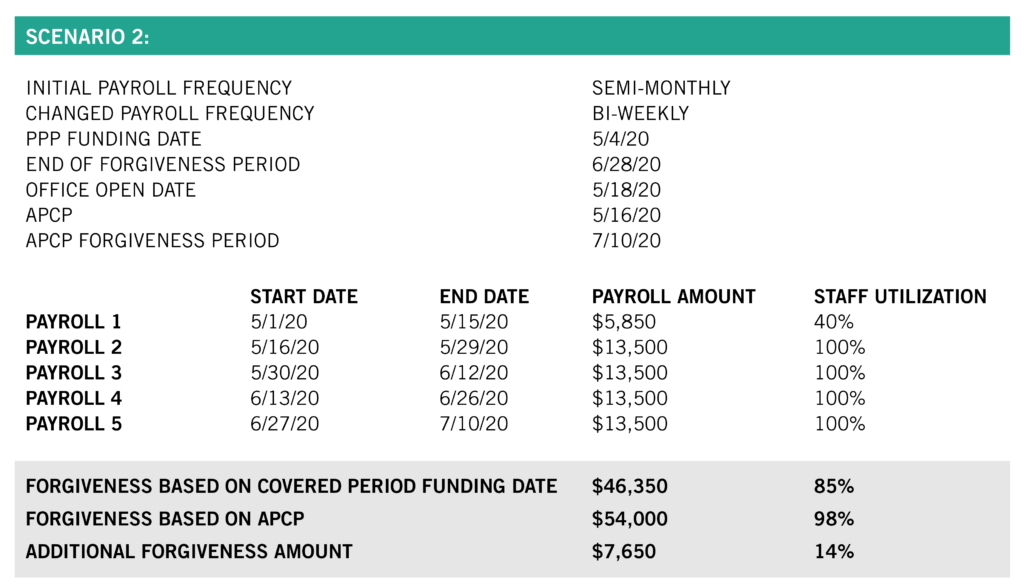

SCENARIO 2: SEMI-MONTHLY

Assume your business runs payroll semi-monthly. You receive the PPP funds on May 4 and your normal semi-monthly pay period covers May 1 through May 15 wages. In this scenario, you reopened your practice on May 18. Your default CP would be May 4 through June 28. If you were to elect the APCP, you would have to change your payroll frequency to bi-weekly.

This would alter your payroll period to run from May 16 to May 29 and allow you to select May 16 as the start of your APCP. In this example, selecting the APCP yields additional forgiveness of $7,650 due to higher staff utilization in the later pay periods.

SCENARIO 3: SEMI-MONTHLY EXAMPLE B

Assume your business runs payroll semi-monthly. You receive the PPP funds on May 7 and your normal pay period ends May 15, covering May 1 through May 15 wages. In this scenario, you re-opened on May 11. Your default CP, without electing the APCP, would be May 7 through July 1. Your APCP would start on the 1st day after the 1st payroll after receipt of the funds, which would be May 16.

In order to use the APCP, you would have to change your payroll frequency to bi-weekly, which would put your next pay period end date to May 29. Electing the APCP in this case would only yield additional forgiveness of $1,800, which may not make sense as the implications of changing payroll periods may not be worth the headache for a marginal increase in potential forgiveness. The APCP does not make a major impact to forgiveness in this scenario because the PPP was received within less than one week of re-opening. The earlier pay period included staff utilization of 80% compared to the previous two scenarios where utilization in the first pay period was 40%.

CWA Insight: When Does the APCP Make Sense?

Selecting the APCP can make sense if:

- Your practice is large, with a high level of annual payroll costs

- Your practice has not reopened yet or you received your PPP funds well in advance of your open date

Selecting the APCP may not make sense in the following cases:

- You reopened your practice shortly after receiving your PPP funds

- You and related parties are the sole “staff” employed by your entity

- Your practice has already run more than one payroll after receipt of the PPP funds

As illustrated, in certain cases, selecting the APCP can make sense by increasing your PPP loan forgiveness. In others, the administrative implications of changing payroll frequencies may not be worth selecting the APCP. If you elect not to change your business’s payroll frequency you can simply elect to run one additional payroll for a shortened period at the end of your CP.

Looking Ahead

There is discussion in the media about Congress potentially extending the 8-week period. If that occurs, the applicability of the APCP may become much less relevant, as most businesses will be able to easily use the funds for payroll costs within a longer covered period.

We encourage you to familiarize yourself with the above analysis, as it is very likely you will fall into one of the above scenarios. If you still have questions on whether you should select the APCP for your PPP loan, please work with your CWA planning team for additional guidance on the best course of action for your personal situation.

Still looking for an advisor that focuses on the business side of dentistry? Schedule a complimentary consultation with a member of our team.