The commonly known deadline for filing your personal tax returns with the IRS is April 15, however you may have heard about another option. In this month’s edition of “Ask a CPA,” we address a recent question on tax extensions:

“My CPA says I need a tax extension. What does that mean?”

CWA planner Brittany Frazier says it’s very similar to how it sounds.

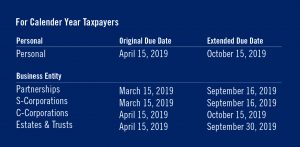

“An extension is a form filed with the IRS requesting additional time to file your federal tax return,” she said. “The extension period is six months and pushes the deadline from April 15 to October 15.”

Extending your personal tax return provides additional time to file returns without penalty. This can be helpful or even necessary when you are waiting for missing information or tax documents (like 1099s or K-1s).

It can also be beneficial if you may qualify for additional retirement planning opportunities or need extra time fully funding certain types of retirement plans. Overall, it’s often less expensive and easier to file an extension rather than rushing now, or possibly needing to amend later due to mistakes or oversights.

Brittany says that she may recommend an extension for many unique reasons, but some common ones are:

– Large volume of data or complexity of certain transactions either on the personal side or related to the owner’s business. For example, sale or purchase of business, debt refinancing, or deployment of additional tax planning strategies would likely require extra time and attention to detail.

– In anticipation for late-arriving data. Many clients are invested in businesses, requiring additional supporting documentation to be reported on personal tax returns. Examples of this could be K-1s from trusts, partnerships or S-corporations which often are not supplied to clients prior to the April deadline.

– If there is the ability to save more into tax-deferred retirement plans within a particular tax year, allowing to spread out the cash flow over an additional six months.

Expect to pay anticipated taxes owed by April 15

An extension offers additional time to file, but not additional time to pay. Penalties may be assessed if sufficient payment is not remitted with the extension. You still need to submit all available tax information to your CPA, so they can determine if you will have a balance due or expect a refund.

If you are required to make quarterly estimated tax payments, your first quarter estimated payment is due April 15. Brittany typically recommends her clients pay the balance due for last year and the first quarter estimated tax payment for this year when filing the extension.

Filing the extension

For CWA tax clients, it is a best practice to extend every return. The tax team takes care of this on your behalf. For non-clients, reach out to your CPA, as they should be able to file either your extension or your return by the deadline.

Extending your tax return does not increase your likelihood of an audit. It is better to file an extension rather than to file a return that is incomplete or that you have not had time to review carefully before signing.

Deadlines:

Still not sure what you should do? Each situation is unique. For a personal answer, contact us for a complimentary consultation.

Do you have a financial question you’d like one of our CPAs to weigh in on? Submit your question below (anonymously) and each month we will feature a new question—answered by one of our financial planners.

Want a more personal answer to your tough questions? Contact us at cainwatters.com/contact.