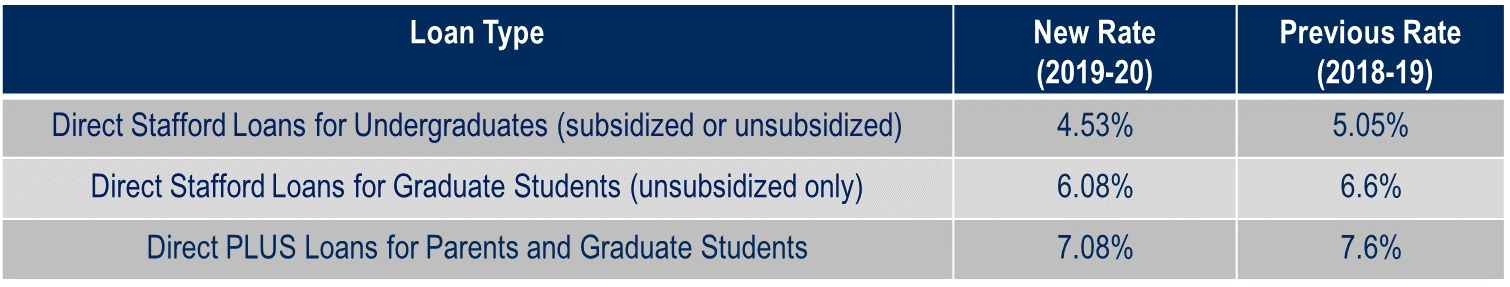

Every year, interest rates on new federal student loans are reset by Congress for the upcoming academic year. For the first time in three years, interest rates will decrease in 2019-2020 for borrowers. The lower rates apply only to new federal student loans disbursed between July 1, 2019, and June 30, 2020.

With subsidized loans, the federal government (not the borrower) pays the interest that accrues while the student is in school, during the six-month grace period after graduation, and during any loan deferment periods. With unsubsidized loans, the borrower is responsible for paying the interest during these periods. Only undergraduate students are eligible for subsidized loans, and eligibility is based on demonstrated financial need.

The rates above are what are charged for Federal student loans, not private student loans. The interest rates charged by private student loans are set by the individual banks, and sometimes are even better than the Federal loan interest rates.

However, private loans don’t offer a lot of the features of Federal loans, such as income-driven repayment plans, student loan forgiveness and more. However, it’s important to keep in mind the whole picture about where to borrow—and not just interest rates. A CPA can help you navigate the right decision for you or your child.

Overall, this is positive news for borrowers. Given that student loan interest rates have decreased, borrowers can expect to see savings on the total cost of their education.

Credible estimates that the average borrower will save anywhere from $199 to $805 per year, depending on the type of loan they have. That is a substantial savings that can help cover other expenses that college students face, such as rising textbooks costs, supplies and more.

Would you like to ensure you select the best student loan option for your family? Contact your CWA planner to evaluate your options. Not yet a client, visit cainwatters.com/contact to reach out.