There are some important deadlines fast approaching in September and October, and we do not want you to miss them. So, we interrupt your daily...

Market Whiplash and CPI – Ep. 229

CWA

April 15, 2025

NASDAQ saw its biggest day in point history with a 12-point surge. After the market dropped due to tariffs, is the economy in the clear?

Loading...

by

CWA

•

September 11, 2017

< 1 MIN READ

by

CWA

•

June 7, 2017

True, it’s only June, but you know how the summer goes. With busy season at the office, vacation with the family and long holiday weekends,...

< 1 MIN READ

by

CWA

•

May 9, 2017

A new set of clubs? Airline tickets for this summer’s vacation? Paying off that digital intraoral x-ray sensor that you bought last summer? How do...

2 MIN READ

by

CWA

•

May 8, 2017

CWA Managing Partner Dan Wicker gives an update on the Tax Reform Outline and the effect changes may have on individuals and business. Last November...

2 MIN READ

by

CWA

•

April 10, 2017

If you’ve filed your tax return before the deadline, don’t be in the dark about when you will get your federal tax refund. More than...

< 1 MIN READ

by

CWA

•

March 7, 2017

As of the 1st of this year, the IRS lowered the 2017 standard mileage rate from the 2016 rate, changing the percentage of your driving...

2 MIN READ

by

CWA

•

March 7, 2017

Clients will receive their 2016 tax documents securely for review and e-signing through SafeSend Returns. This simple, easy-to-use electronic delivery software will streamline communication between...

< 1 MIN READ

by

CWA

•

January 6, 2017

It's time to start gathering your 2016 tax forms and financial records to send to your tax preparer for the 2017 filing season. There’s still...

2 MIN READ

by

CWA

•

April 12, 2016

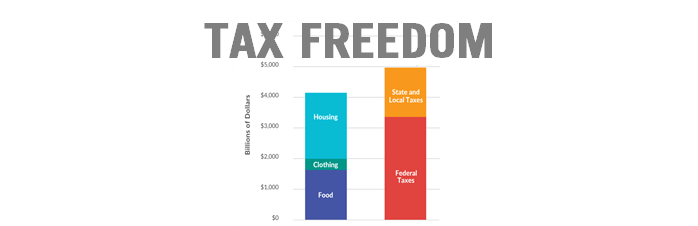

Freedom is only a couple of weeks away... Tax filing day falls on April 18 this year and most Americans, at least the ones who...

< 1 MIN READ

by

CWA

•

March 31, 2016

There’s now a new safe and secure way for CWA clients to electronically sign Form 8879, E-File Authorization form, for Individual Income Tax Returns* starting...

2 MIN READ

by

CWA

•

January 29, 2016

Resolved to stay on top of administrative work? Let us help. Print this quick-reference calendar for easy access to this year’s important IRS dates and...

2 MIN READ

End of content

No more pages to load

GET THE LATEST NEWS AND INFORMATION IMPACTING YOUR PRACTICE.

Email will be used in accordance with our Privacy Policy

CATEGORIES

Categories

- Accounting (8)

- Accumulating Wealth Podcast (182)

- Annual Meeting (14)

- Digital News Feature (151)

- Financial Planning (134)

- Inside CWA (28)

- Investing (50)

- Knowledge & Know-How (78)

- News (83)

- PR/Marketing/Social Media (4)

- Practice Management (91)

- Practice Transition (3)

- Seminars & Events (12)

- Tax News (95)

- Technology (5)

- The 3to1 Foundation (12)

- The Advisors' Shelf (11)

- Videos (32)

TOP POSTS

Market Whiplash and CPI – Ep. 229

April 15, 2025

Shifting Into High Gear: Ortho Trends – Ep. 228

April 8, 2025

Liberation Day: Tariffs Update – Ep. 227

April 7, 2025

Meals & Entertainment Tax Deductions for 2025

April 4, 2025

Market Whiplash and CPI – Ep. 229

April 15, 2025

Shifting Into High Gear: Ortho Trends – Ep. 228

April 8, 2025

Liberation Day: Tariffs Update – Ep. 227

April 7, 2025

Meals & Entertainment Tax Deductions for 2025

April 4, 2025