Details surrounding how to claim this credit in 2020 and 2021

In late December, Congress passed the Consolidated Appropriations Act 2021 (CAA), a bill combining stimulus relief for the COVID-19 pandemic and preventing government shutdown.

With its passing, it brings significant changes to the Employee Retention Credit (ERC) created as part of the CARES Act.

The CAA changes are retroactive to March 12, 2020 and extend the ERC from December 31, 2020 until June 30, 2021. The most significant change allows borrowers under the Paycheck Protection Program (PPP), the ability to claim the ERC credit for 2020 and 2021. While this presents an opportunity for clients to recoup some of their payroll costs via a tax credit, the CAA stipulates that you cannot duplicate payroll expenses for the ERC and the forgiveness of loan proceeds under the Paycheck Protection Program.

The CAA further modified the calculation of the credit originally included in the CARES Act. However, it is important to note the changes to the calculation do not apply to 2020 but rather only apply to 2021 credit calculations. Any credit taken for 2020 under the new act will still be calculated using the criteria under the CARES Act.

Impact of Changes on 2020:

As a refresher, under the CARES Act the ERC is allowed if:

- Operations were fully or partially suspended by government order; or

- Collections dropped by 50% or more for any quarter in 2020 when compared to 2019

If an employer met one of the above criteria in 2020, then the ERC was allowable. For criteria 1, the credit was allowable for the period the suspension order was in effect. For criteria 2, the credit was available for the quarter that collections dropped by 50% when compared to the same quarter in 2019 and each subsequent quarter until collections exceeded 80% of the same quarter of 2019.

The credit was computed as 50% of the eligible wages of an employee up to the maximum of $10,000 for ALL quarters. Therefore, the maximum credit allowed per employee for the year was $5,000.

CWA Analysis:

Given that the CAA has opened the credit up to borrowers under the Paycheck Protection Program, most clients would qualify based on having operations fully or partially suspended as a result of a government mandate during March, April, May and in some cases into June, of 2020. Clients should also review collections for each quarter in 2020 compared to 2019 to determine if they experienced a 50% decrease.

CWA believes most of their clients will not have experienced a 50% decrease in collections. If they have, most will have collected 80% or more in quarter ending September 30, 2020 as compared to 2019. If you do meet this criterion, then you may be able to claim the credit for the second and third quarters of 2020.

The following is a discussion of the credit under each qualifying scenario listed above:

Government Mandate:

If your practice was closed or operations partially suspended due to a government mandate, then you will qualify for the credit from the time the mandate went into effect until the time in which the mandate was lifted for elective procedures.

The following steps should be followed to determine if you qualify and how to calculate and report the credit:

- Determine the date the mandate went into force and the date upon which the mandate was lifted for elective procedures.

- Produce an employee earnings report for the dates of the shutdown. Your payroll company can help you run this report.

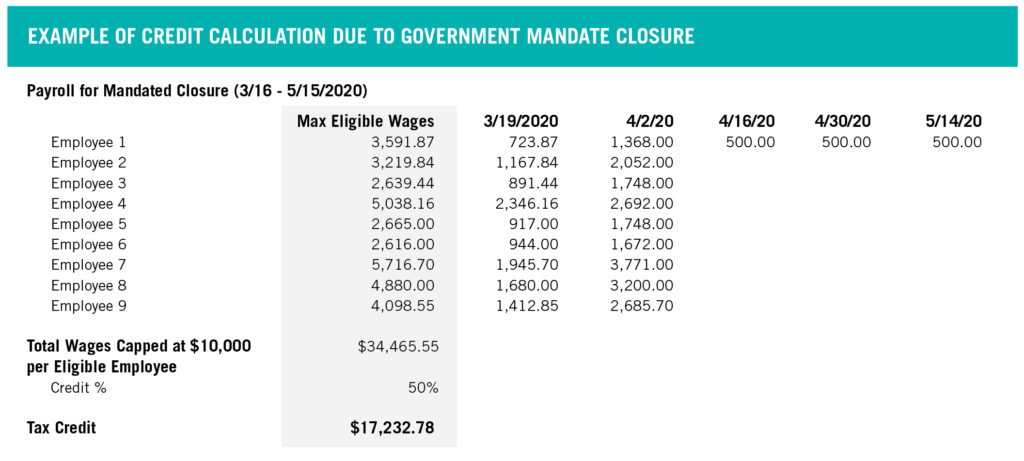

- Limit wages to $10,000 per employee during the mandate period, excluding owner and family salaries.

- Apply 50% to the wages as calculated to arrive at the amount of the credit.

As of the date of this publication, the IRS has yet to issue regulations on how to claim the credit. In CWA’s discussion with a national payroll company, we anticipate this will be able to be claimed on your Q1 or Q2 2021 quarterly payroll tax return filed by your payroll company.

The following example illustrates the application of the credit calculation for a client whose practice was partially suspended by a government mandate from March 16 – May 15.

CWA Analysis:

As previously stated, we expect most, if not all, CWA clients will meet the criteria to claim the credit for being partially shutdown due to government mandate in 2020. Each client should follow steps 1-4 above to prepare to claim the credit once the IRS issues regulations. CWA will keep you updated once the IRS issues regulations.

50% Decrease in Collections:

To determine if you qualify for the credit due to a decrease in collections, the following steps should be implemented:

- Determine if your collections for any quarter in 2020 dropped more than 50% when compared to the same quarter in 2019. This would likely be only in Q2 2020.

- If your practice qualifies, then you could get this credit starting March 12, 2020 through the quarter in which your collections return to 80% or higher from the previous year. You will need to obtain an employee earnings report with the start date of March 12 through the end of the quarter in which collections resumed to 80% or higher.

For example, if the practice collections decreased by 50% or more in Q2 2020 but in Q3 2020 were at least 80% of Q3 2019 then you would need the employee earnings report from March 12 – September 30, 2020.

- Limit wages to $10,000 per employee during the period excluding owner and family salaries.

- Apply 50% to the wages as calculated to arrive at the amount of the credit.

CWA Analysis:

CWA believes that 15-20% of clients will qualify for the credit based on a 50% decrease in collections. However, you should review your collections for Q2 2020 vs. Q2 2019 to determine if you do meet this criterion. If so, you should notify you CWA advisor to help evaluate whether taking the full credit will jeopardize the ability to receive full forgiveness of your PPP loan, since the wages cannot count for both the ERC and PPP forgiveness. When evaluating the impact, keep in mind only the wages up to $10,000 per employee are excluded from PPP forgiveness.

Impact of Changes on 2021:

The CAA made changes to the calculation of the ERC, but these changes only apply to Q1 and Q2 2021. An employer will qualify if collections from Q1 or Q2 of 2021 decrease by 20% or more compared to the same quarter(s) in 2019. If the employer was not in business in 2019, then the employer can use the same quarter(s) in 2020.

Assuming you meet the collection criteria, the ERC is calculated as 70% of qualified wages up to a maximum of $10,000 per employee per quarter. The CAA increases the applicable percentage from 50% to 70% and makes the credit available per employee, per quarter.

CWA Analysis:

The changes to the calculation for 2021 are significant. Unfortunately, most practices will not be eligible for the enhanced calculation unless they see at least a 20% decrease in collections in Q1 or Q2 2021 compared to 2019.

Conclusion:

The CAA has created an opportunity for clients to recapture some of the costs incurred for employee wages if you qualify under the ERC regardless of whether you received a PPP loan. Since most practices had a government mandate to partially shut down, we believe most clients will qualify. When evaluating whether to pursue the ERC, careful attention should be paid to ensure that wages are not being counted for both the ERC and the forgiveness of the loan under PPP.

The CAA is not clear on how the credit is to be claimed for quarters previously filed. We believe the credit will be claimed on quarterly payroll filings in 2021. Once we have the additional guidance, CWA will be able provide the process to claim the credit for those clients that qualify based on the CAA revisions.

This ERC is complicated. In the next week CWA will be releasing a webinar to help walk through the details.