Plan ahead with this tool to get the most from these credits

The Inflation Reduction Act, signed into law this summer, includes expanded or extended tax credits that support energy-saving investments for taxpayers.

Some consumers may qualify for over $10,000 in financial incentives if they purchase clean vehicles, install solar-roof panels and appliances, or take other steps to reduce their carbon footprint. Although you may need to wait until 2023 or 2024 to begin seeing these financial benefits, planning ahead will help you decide if and when to take advantage of these incentives.

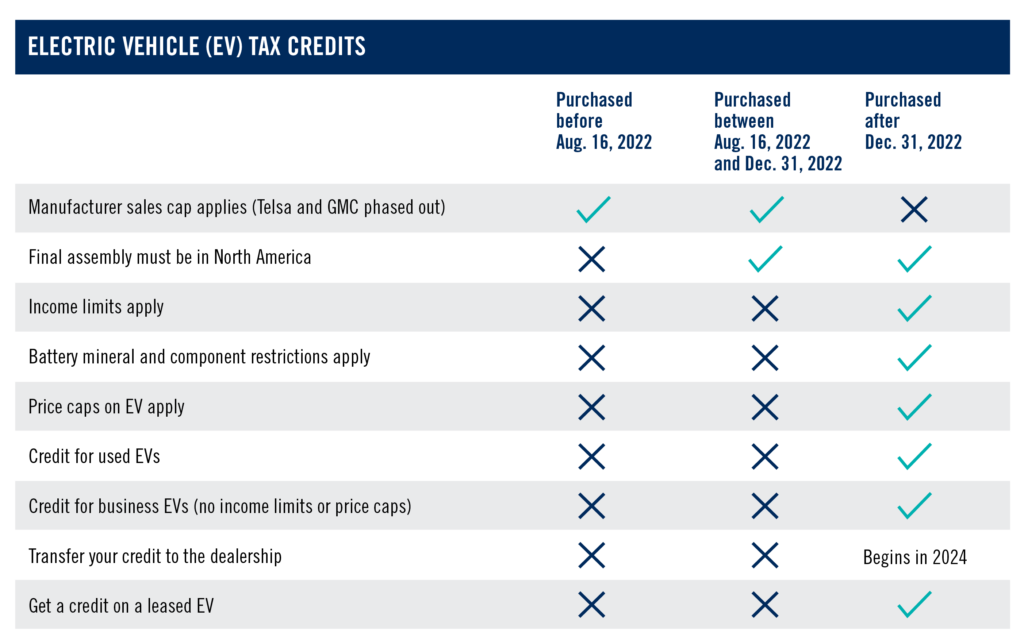

New or Used Electric Vehicles

Incentives for both new and used electric vehicles sound appealing, but like most tax credits, there are many variables that effect eligibility. Several of them may influence the timing for buying your new or used electric vehicle.

Consumers who buy a new electric vehicle can get a tax credit worth up to $7,500. In addition to requirements surrounding assembly location, price caps and more (see chart below), there is a limit on annual income to qualify. If you make more than $300,000 AGI for joint filers, $225,000 for head of household or $150,000 for all others, you are disqualified from receiving the tax credit.

Previously excluded in 2022, manufacturers like Tesla and GMC are now eligible starting Jan. 1, 2023.

And there’s more good news: used vehicle purchases now qualify for the federal tax break starting in 2023 through the end of 2032 up to $4,000. The credit is equal to the lesser of $4,000 or 30 percent of the vehicle’s sale price.

Similar to new vehicles, each credit for used vehicles comes with various requirements tied to the consumer and vehicle, such as household income, sales price and final assembly location. Income limits for used vehicle qualification are $150,000 for joint filers, $112,500 for head of households and $75,000 for all others.

Note: There is no credit for leasing an electric vehicle.

COMING SOON: In 2024, you can transfer the credit to the dealership instead of waiting to file a tax return. The taxpayer must make the election by the date of the purchase to get the benefit of the credit when they purchase a qualified clean vehicle. The transferred credit reduces the electing taxpayer’s basis in the vehicle, as well as any other deduction or credit the taxpayer may claim for the vehicle.

There will still be qualifications that must be met, likely caps surrounding the taxpayer’s AGI or the vehicle’s MSRP. More guidance to follow from the IRS on how this will be implemented.

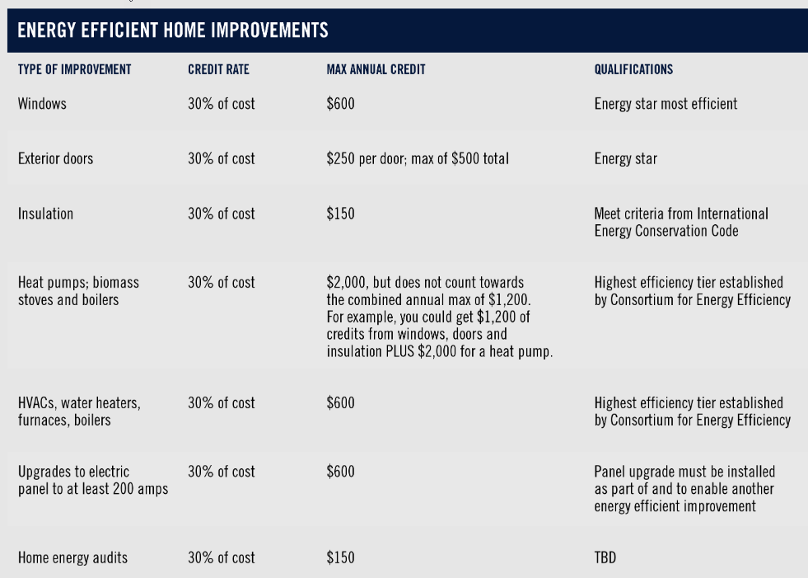

ENERGY-EFFICIENT HOME IMPROVEMENTS

There are also increased incentives for homeowners who make energy-efficient upgrades. These credits were designed to help offset the price of things like installing energy-efficient skylights, insulation, exterior doors and windows and even solar panels or other equipment that harness renewable energy. There are also separate credits for heat pumps, heat pump water heaters and biomass stoves and boilers.

Previously called the nonbusiness energy property credit, and capped at $500 per lifetime, these credits have now increased to $1,200 per year. This applies to property placed in service after Dec. 31, 2022, and extends through Dec. 31, 2032.

The credits are capped at lesser of either 30% of your cost or $1,200 total. This is spread across all improvements, with the exception of heat pumps, which are capped separately. See the table below for full details on the calculations for each type of improvement.

It’s important to note that if your utility company offers a rebate for installing energy-efficient improvements, you’ll need to deduct that rebate from your cost before calculating your 30% tax credit.

PLAN AHEAD NOW

If you complete and install a project in 2022, it’s not going to be eligible for the new incentive, however, costs incurred in 2022 for a project completed in 2023 would still count toward the overall value of the tax break.

One caveat: Since these are tax credits, you will only realize the financial benefit when filing your annual tax return.

In order to best take advantage of the energy-efficient home improvement or electric vehicle options, planning your purchase ahead of time will help the process go more smoothly. Ensure your purchase and installation dates meet the requirements in the tables listed above to qualify and notify your CPA if you plan to take advantage of these credits in the next calendar year.

Leveraging tax credits like these is just one piece of the tax strategy puzzle. Our CPAs and financial planning teams work to create a strategic plan to help reduce your tax liability year-round.