Unusual times often illuminate guiding principles. Here’s four from one of our most experienced advisors.

At this very moment, we are living through an extraordinary time. Have you found yourself staring at the stock market tickers and wondering: will things ever settle down?

Maybe you’ve even been tempted to take your money and stick it under your mattress until it’s over. Or, is there a better, more strategic approach you should be taking to come out ahead in the long term?

These are the kinds of questions that motivate Hunter Satterfield, CPA, member of CWA’s investment committee and avid learner. After seeing the uncertainty and fallout of the 2008 financial crisis, Hunter and others set out to codify a set of rules that became the five pillars of investing at CWA.

Those pillars are asset allocation, diversification, rebalancing, goals-based investing and fee management–all of which guide investors in times like these so they can minimize the downside and make rational decisions.

“Investing is a skill but also a process,” notes Hunter. “Baseball players study pitchers which allows them to anticipate and train for sudden changes in the types of pitches during a game. The stock market is a lot like this. What you need is a good set of rules and principles to follow. As soon as you get a curveball, you’re more likely to get a hit because you can see that it’s coming and know what to do.”

No matter if you are picking up your first bat or have been playing in the major league for years, a guiding set of rules and principles are essential to protecting your investment.

Investing Insights From COVID-19

While these pillars have guided our clients through the recent tumult, Hunter notes that during the pandemic, he compiled some surprising insights:

1. Markets and the economy are not always intertwined.

Popular belief and our gut may tell us that the stock market and the economy are tightly linked; however, increasingly data tells a different story. During the pandemic, from mid-February to mid-March jobless claims were at 1 million and the market was down 30%. From mid-March to mid-April jobless claims were at 26.5 million and the market was up 30%.

“I’ve never seen a better indication of how the economy and stock market are disassociated or divorced from each other,” notes Hunter. “It’s probably the most significant data point I’ve seen in my investing career.”

2. Losses and gains are asymmetrical, which can have an emotional impact.

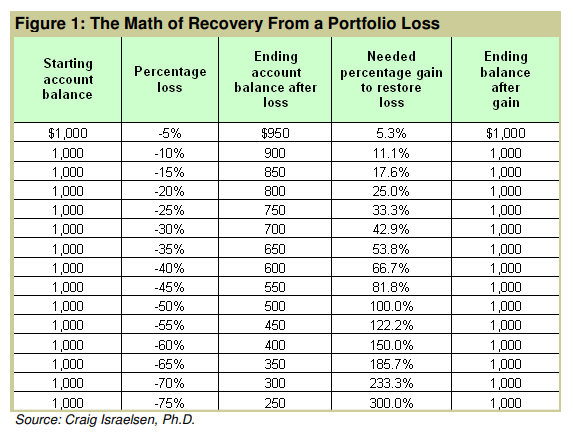

In the same way that compounding interest can bolster your investments over time, the math of percentages highlights the damage that loss can have on a portfolio. As loss gets bigger, the gap to recover the loss increases at an exponential rate. That means a 50% loss can’t be made up by a 50% gain. You actually need a 100% gain. See the following example of the gains needed to recover from a variety of losses.

This can be disheartening, especially during times like these; but it’s not meant to scare you.

“The goal is to define a process to minimize risk for compounding losses. You cannot control the stock market, but you can control the process,” emphasizes Hunter. “And the more you can control the process, the better you can control the outcome.”

3. Define a process for decision making. Use a rules-based approach to investing.

Gaming out different scenarios with a financial advisor helps not only to define an investor’s level of risk, but also creates a set of guiding rules to persevere through the highest highs and lowest lows. When things get scary or overwhelming, relying on these rules removes emotion from financial decision making.

Asset allocation and diversification are two important strategies individual investors can focus on. Asset allocation is simply the percentage of your portfolio invested in stocks, bonds and cash.

A well-devised asset allocation does not ensure you are appropriately diversified, however. For example, if you have determined that you should have 60% of your investments in stocks, you shouldn’t invest that full 60% in one stock. Being diversified in all the different asset classes can help achieve the long term returns you need while smoothing out the volatility on the downside.

“Even financial planners are emotional beings. I knew it beforehand,” Hunter shares. “I knew that having a process for decision making was important. But I saw in myself that emotion happening, and said, ‘Ooh, I know we set that rule, but man, those red numbers look really bad. Are we sure?’

“Especially now, investing is going to be a highly emotional rollercoaster. Defining and adhering to these types of principles, essentially, we are divorcing ourselves from emotion. This is what makes an investment strategy crucial during this time.”

4. Rebalance portfolios and focus on target allocations.

A diversification strategy allows investors to have a target allocation that corresponds to their preferred level of risk and financial goals.

Over time, however, the different assets have different returns/losses and so the amount of each asset changes—one stock or fund might have such high returns it eventually builds up to be a larger portion of the portfolio than planned. When a portfolio is rebalanced, it realigns a portfolio by buying or selling assets–like stocks or bonds–to safeguard your money from undesirable risks.

“At the beginning of the pandemic, the stock market was cratering and the bond market was holding a little bit firmer,” Hunter said. “So, we rebalanced the portfolios and as the market has retraced back up, our portfolios on average have benefited.”

You can do portfolio rebalancing yourself—sell some assets, buy up some others. Most online brokerages allow you to buy and sell on your own for minimal fees. Portfolios can be rebalanced at set points in time (quarterly, monthly, annually) or at set allocation points (when the assets change a certain amount). A good rule of thumb is to rebalance when an asset allocation changes more than 5%.

Moving Forward

As the pandemic continues to unfold, the market will likely continue to present investors with some surprises. But market volatility doesn’t have to mean you won’t be able to reach your long-term goals or retire when you want too. Although it is an unprecedented time and emotions are high, should your behavioral biases be getting the best of you, it may be a good time to ask for help.

“If after 13 years of study and investing, I was concerned when we hit the bottom, then the average person likely needs help,” Hunter acknowledges. “An advisor is a person coming from a place of wisdom. It’s an outside voice that can help remove the emotion from decisions and bring additional insight.”

As we all navigate this time, don’t forget to reach out to colleagues, associates and available resources. For more on the topic view our resources at cainwatters.com/investments.

If you don’t have an experienced financial planner to bolster your financial goals during this time: we’re here to help. Reach out for a complimentary consultation from one of our experienced advisors.