March 19 update on T Bank & UMA Model Performance from affiliate Tectonic Advisors

Here is a brief update on how investment models are performing.

Volatility remains very high, and now that includes the bond market. A global shortage of U.S. dollars is putting pressure on the Treasury market liquidity, which is producing continued swings in bonds that have coincided with down days in equities.

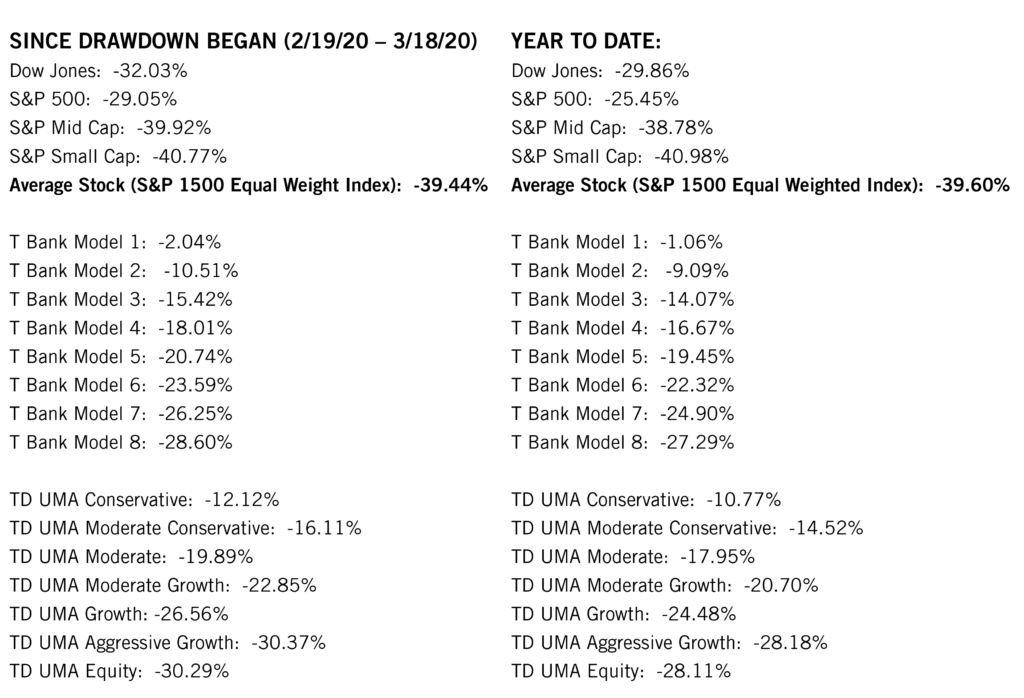

The average stock (as measured by the S&P 1550 Equal Weight Index), when looking at the breadth of the market, is down just shy of -40% YTD. The T Bank Equity Fund is down approximately -27%.

On Wednesday, March 18, the bond market was -3.5%. The Core Fixed Income fund at T Bank was down -1.4%. This is above expectations.

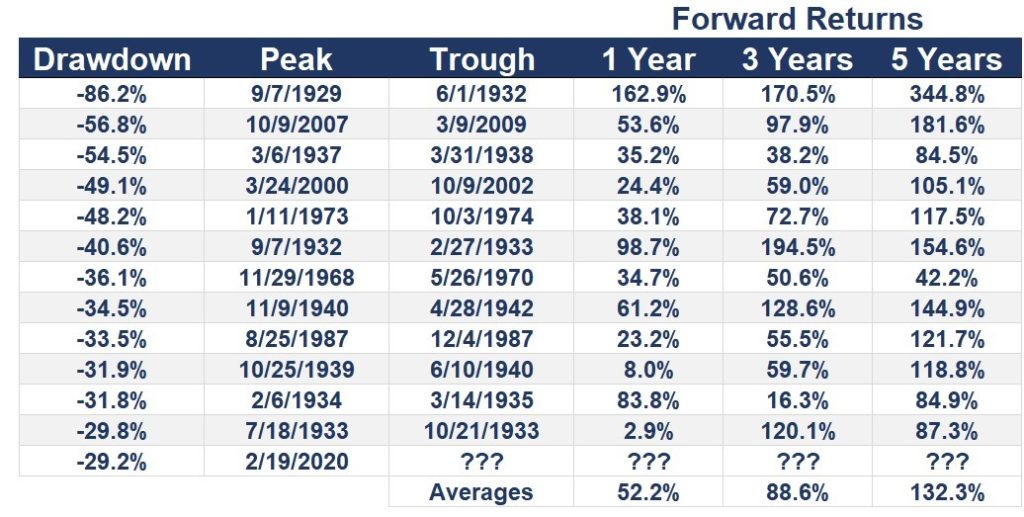

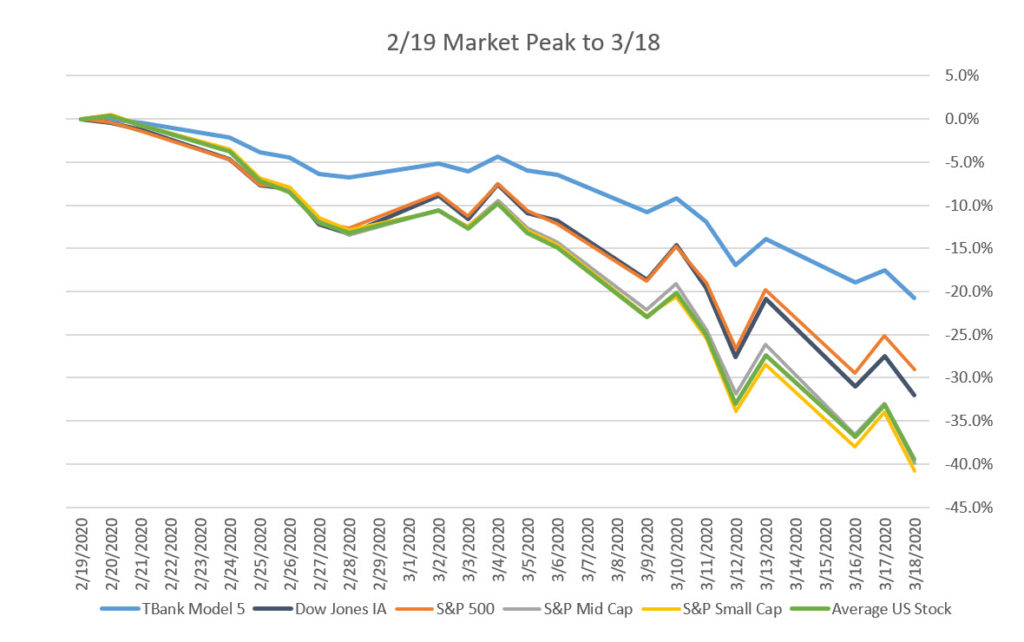

Below you will see a chart of how T Bank Model 5 has performed through the drawdown period since Feb. 19. There is also another chart that shows various drawdowns in the market dating back to the early part of the 20th Century (courtesy of Ben Carlson at A Wealth of Common Sense).

Source: www.awealthofcommonsense.com

As a society, it can feel bereft of good news right now, nothing seems to be improving and it can begin to feel like it will never end. The chart above illustrates how even the worst periods throughout history do in fact end and in short order things improve markedly on average.

Periodic communications may continue, however please contact your planning teams or Tectonic Advisors with any additional questions or concerns.

Bookmark our COVID-19 Resources Page for easy access to updates and guidance from CWA and its partners.