Key takeaways

- Rather than excessively cutting costs in the face of ongoing challenges, focus on maintaining essential resources.

- Determine where your dental practice falls into the three phases of growth: Cost structure optimization, stabilization or expansion.

- In every phase, having a trusted team of advisors is essential for effectively planning and implementing growth strategies.

Well into an inflationary cycle, the cost of doing business is still a challenge for dental practice owners. Salaries are still inflated. Supply costs remain elevated. Rent is up. Reimbursements are flatlining or falling.

How do dentists manage overhead and increase profitability in this challenging environment? According to Sam Richter, CPA at CWA, it’s time to reframe the dental practice cost control conversation.

“Going on three years of inflation, it’s time to accept the new normal of a higher cost of doing business, at least for the foreseeable future,” says Sam.

By that same logic, Sam says dentists can also reframe how they approach lowering overhead and maximizing profitability.

“Rather than employing dental practice cost control strategies that cut out so much fat that we take out muscle, we focus on keeping the muscle to grow our way out of higher overhead.”

To do this, Sam breaks down dental practice growth into three phases. But before diving into each one, Sam suggests dentists first look at where their overhead compares to the national averages.

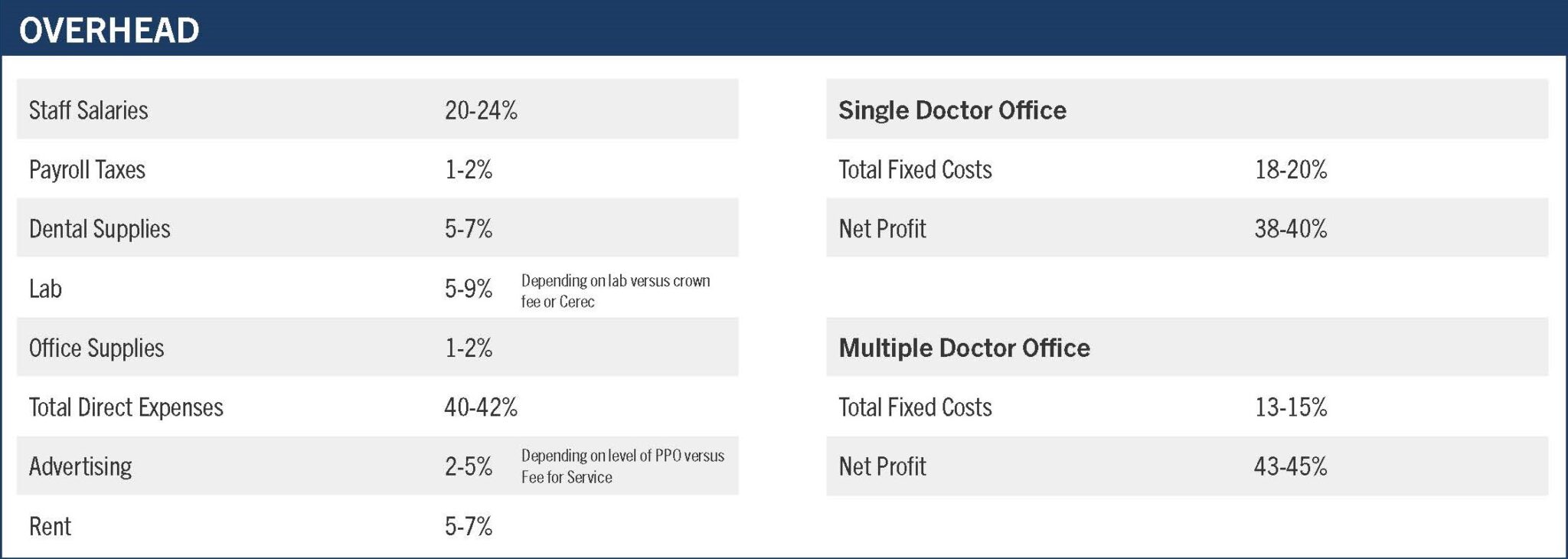

Each year, the CWA team compiles client data across six specialties into the How Does Your Practice Compare? Report. The latest edition shows that the average overhead for a GP should fall into the following ranges:

“Now that we know how our expenses compare to the averages, we look at where the practice falls into the three phases of growth to create a plan to optimize it,” says Sam.

PHASE ONE: GETTING YOUR COST STRUCTURE IN PLACE

Cost structure is synonymous with overhead. It’s essentially how a dentist structures his or her operations to minimize dental practice business expenses and maximize profits. This includes things dentists can control, including:

- Optimizing staffing levels and salaries (to an extent)

- Renegotiating supplier contracts

- Streamlining administration processes

- Consistently raising fees to keep up with inflation

It also includes expenses dentists can’t easily control, like the interest rate on new equipment purchases or the rent payment in year two of a 10-year lease.

“This is where consulting an advisor well in advance of making these big decisions can make a huge difference,” says Sam. “For startups looking for a new building or practices within two years of lease renegotiations, a misstep can set a practice’s cost structure back five years or more.”

An advisor can also run proformas to show the ROI of new equipment and connect practice owners with companies like Elite Dental Alliance that specialize in purchasing.

“Managing costs is always an important factor in controlling expenses,” says Sam. “But from my experience, the single biggest deterrent to practices trying to grow out of high overhead is PPO insurance reimbursements.”

Even if a dentist raises fees 10%, Sam says the insurance contracts handcuff many practices. Some providers have lowered reimbursement rates, further hindering profitability.

According to Sam, the solution for some practices is to transition to a Fee-For-Service (FFS) model. It is important to note that this isn’t for everyone. Some practices need insurance plans to build up patient flow, and that is okay. Others may have a good reimbursement rate and no need to make a move. But for those considering it, there are strategies to optimizing the FFS transition, starting with talking to an advisor who can run proformas and map out a transition plan.

“When done diligently with a solid strategy in place, the vast majority of practices transitioning to FFS have shown marked increases in growth and profitability, with less stress on doctors and staff,” Sam adds.

PHASE TWO: STABILIZATION

Once the cost structure is optimized and the business has seen growth for several years, practices enter what Sam calls the stabilization phase. In this phase, practice owners typically see 4-7% growth as the business maximizes its footprint and earning potential.

Many dentists choose to stay in this phase until retirement. In that case, Sam shifts the focus to financial planning, optimizing tax and investment strategies to make the most of the cash flow coming in.

Adding a new associate during this phase can help lighten the load and properly position the practice for a transition when the time is right. Sam notes that planning for this should start at least five years before the transition.

“Partnership negotiations are often complex and emotionally charged,” says Sam. “Having the right team of practice transition experts and financial advisors in your corner is critical at this stage.”

PHASE THREE: EXPANSION

For dentists looking to expand by adding locations, it’s crucial to make sure the practice has reached the stabilization phase before executing any expansion plans.

“The primary practice is your foundation,” says Sam. “You want to make sure to protect it.”

Step one is to clarify your expansion goals, create a plan and map out the timeline.

“I’ve seen owners with three locations working 12-hour days to keep up,” says Sam. “But the real problem is, location three isn’t profitable and is sapping precious resources from locations one and two. This could threaten locations one and two and cause the whole organization to suffer.”

The bottom line is that expansion can be a lengthy process, and it takes a team of advisors to ensure that it’s executed correctly.

Step two is hiring a rockstar associate to take over the existing practice. A consultant like NDP can help find the right associate who can maintain your practice while the primary doctor focuses on growth.

“Keep in mind, the new associate will need time and guidance to keep your existing location positioned in that stabilization sweet spot,” says Sam. “This can be a two-year process, so plan accordingly.”

Whether you’re in phase one and looking for ways to lower dental practice business expenses, comfortably enjoying the stabilization phase or have grand long-term expansion goals, Sam says the key is to make sure your cost structure is ready to make those plans a reality.

“Having a team of trusted advisors in place to help you plan and execute your ambitions is the first step, no matter what phase you are in.”

To learn more about how your practice compares to the averages across an array of categories, dive into the How Does Your Practice Compare? Report. Or to learn more about the three phases of dental practice growth and where your practice stands, talk to a CWA advisor today.