You might spend your career building your savings with the long-term goal of enjoying the fruits of your labor in retirement. But planning for retirement requires looking at more than the money you are able to save now. The state you plan to retire in also impacts your financial future.

Think about it. As you save money now, you are choosing whether to have pre-tax savings or post-tax savings. The post-tax savings is known as Roth savings and is not subject to tax when using those monies in retirement.

Pre-tax savings are monies that receive preferential tax treatment when contributed into a qualified plan. In other words, you receive a tax deduction when you make contributions into the qualified plan.

When you begin drawing these monies in retirement, by at least age 70 ½, you will pay income tax on these distributions. There are no strategies to avoid paying income tax on the distributions to the federal government. However, you do have opportunities to minimize state taxes on the distributions.

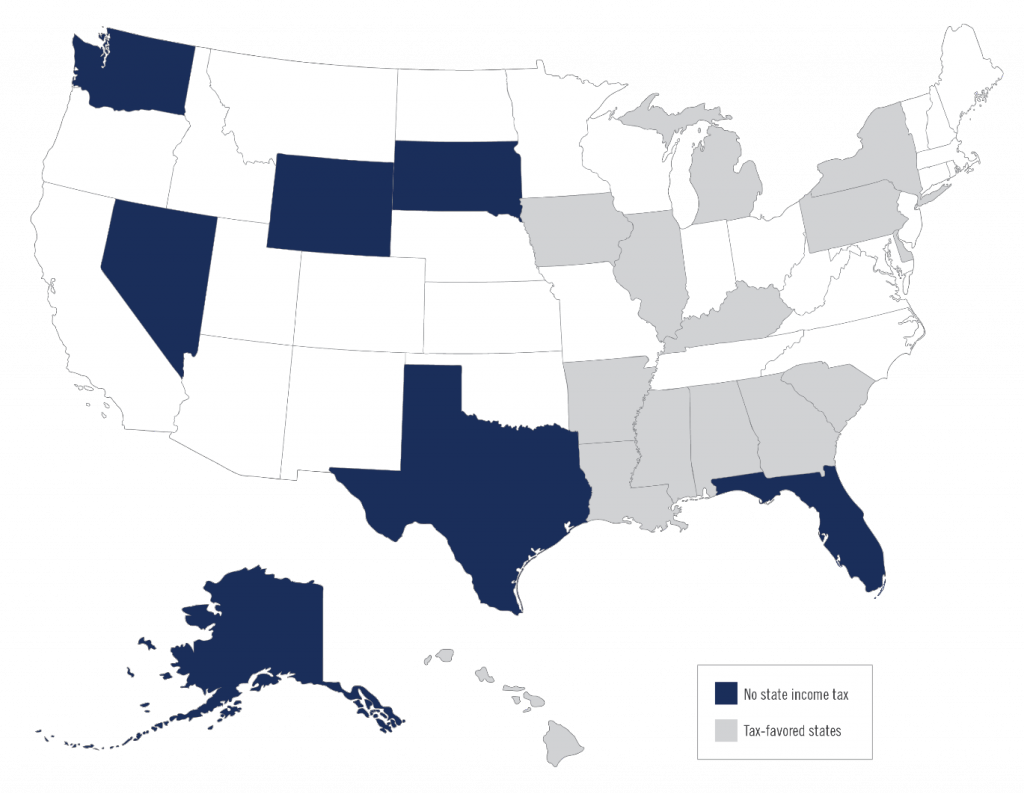

NO STATE INCOME TAX VS. TAX-FAVORED STATES

There are seven states that do not tax individual income. These include Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. In addition, New Hampshire and Tennessee impose an income tax only on dividends and interest at a rate of 5%. Residents of these states will avoid paying state income tax on all qualified retirement plan distributions.

In addition to the seven states with no income tax, there are 14 other states that not only exclude social security from taxation, but also provide tax breaks for qualified distributions.

– Alabama has an unlimited exclusion for distributions from defined benefit plans.

– Arkansas allows those over 59 ½ a $6,000 retirement plan exclusion.

– Residents of Delaware over the age of 60 receive a $12,500 exclusion for qualified plan distributions.

– Georgia excludes $35,000 of retirement income if you are between the ages of 62-64 and excludes $65,000 for those 65 and over.

– Hawaii has an unlimited exclusion for defined benefit income plans and partial benefit for 401(k) and IRA withdrawals in limited circumstances.

– Illinois has an unlimited exclusion for qualified plan distributions.

– Iowa excludes up to $6,000 of pension benefits for those over age 55.

– Kentucky provides a $41,110 exclusion for pension plan, annuity contract, profit sharing and IRA withdrawals.

– Louisiana eliminates $6,000 of pension and annuity income for individuals over age 65.

– According to your age, Michigan allows an exclusion up to a maximum of $49,861 of pension and retirement income.

– Mississippi excludes all retirement plan income, including IRAs for those over 59 ½.

– New York eliminates $20,000 of pension, annuity and IRA income if over 59 ½.

– Pennsylvania has an unlimited exclusion for retirement plan income, including IRAs.

– South Carolina allows an exclusion of up to $10,000 of any income if you are over age 65.

So the question that must be answered in your retirement planning: Would you be willing to relocate to an income tax-favorable state during retirement?

For some, the answer is no.

For those willing to consider the relocation, the result on your retirement plan can be significant. The process of relocation involves establishing your state of residency in one of the tax-favored states. This involves having your primary residence in that state, having all vehicles titled in the state and actually residing in the state for six months and one day out of the year. You have the ability to still spend considerable time in your prior state of domicile and still receive the benefit of excluding qualified plan retirement income from state taxation.

A CLOSER LOOK: Retiring in a state with no income tax

We recently assisted a client through this decision process as we started putting their retirement plan into action.

FACTS:

– Married, husband age 69 and wife age 61

– State of residency: New York

– Estimated annual income need in today’s dollars: $180,000

– Estimated federal and state tax bracket in retirement: 31.5%

– Taxable Retirement assets: $800,000

– Annuity: $200,000

– Qualified Plan Assets: $1,200,000

– Inflation: 3%

GOAL:

– To maximize retirement savings for the client

– To have money left over for the client’s heirs

CONSIDERATION:

– Having a residence in Florida and spending winter months there versus New York

The first step in their retirement process was to assist the client through the transition of their practice. Upon completion of the sale, we moved the discussion to where they would retire, and the state tax implications of each option.

When running their retirement analysis to compare their New York residency versus relocating to Florida, we made the following assumptions:

– They would begin receiving social security at the husbands age 70 and the spouses age 62.

– They would utilize their retirement assets that are currently subject to tax on dividends, interest and capital gains to meet any need not covered by social security and required minimum distributions.

– They would continue to let their annuity grow tax deferred until they had exhausted their taxable account.

– Tax Rate: Because they are relocating to Florida, we were able to reduce the tax rate in our projection of the state income tax by 5.5% — from 31.5% to 26%.

NEW YORK: Assuming they remain residents of New York we saw that their assets were sufficient to last throughout their retirement years and actually leave an amount of approximately $600,000 to pass on to their heirs based on our assumptions.

FLORIDA: Using the same assumptions as above, we saw that their assets were sufficient to last throughout retirement, but instead of leaving $600,000 to their heirs, they would have assets of approximately $1,750,000 remaining.

Making the decision to relocate generated them an additional $1,100,000 of spendable assets during their lifetime.

THE TAKEAWAY

State taxes can have a large impact on your retirement earnings. If you are open to relocating, then you should sit down with your advisor and evaluate your options to see the impact this decision could have on your retirement assets.