Know the risk of being in and out of the market

Anytime the market has taken a turn, investors wonder whether it’s smarter to stay in the market or get out and try to buy back in at the bottom before the market heads north again.

While it’s never easy watching your investments shrink during a bear market, Partner Brian Bortz says the answer for the vast majority of investors is simple: In the long run, there is more risk being out of the market than being in it.

“Investors with an investment horizon of 10 years or longer should be investing that money based on a well thought out, diversified investment strategy taking into consideration their own long-term risk tolerance,” says Brian. “Once you’ve done that, you don’t need to worry about the ups and downs, just sit back and watch the magic of compounding interest take place.”

Even investors with as short as a five-year investment horizon should consider staying in the market, as history shows that bear markets tend to be much shorter than bull markets.

“The average recession lasts 17 months, whereas the average bull market lasts 37 months,” says Brian. “So even if you’re five years out from retirement, there’s time to catch up and even grow your money before you need to start taking it out.”

Another reason Brian counsels his shorter-horizon clients to stay in the market is that investing doesn’t end the day a person retires.

“Most people consider their investment horizon to be from today until the day they retire, whatever length of time that may be,” says Brian. “What I encourage my clients, is to think past the year they plan to retire, because on the day you retire, you’re still going to be invested. Granted, we will adjust your allocations based on your age and goals to make sure there’s a level of risk protection at that point, but that doesn’t mean pulling out of the market completely.”

WHY TIMING THE MARKET RARELY WORKS

Investment horizon aside, timing the market is difficult. Not only do investors have to know when to get out, they also have to know when to get back in again, which is not an easy task even for the most experienced investor.

“If you try to time the market, you basically have to be right twice,” says Brian. “That very rarely happens. What most often does happen is that investors will be on the sidelines and end up missing out on one of the top 10 or 20 days of the year.”

Being in the market when those top days hit is vital to regaining losses and maximizing gains, and Brian has done the math to prove it.

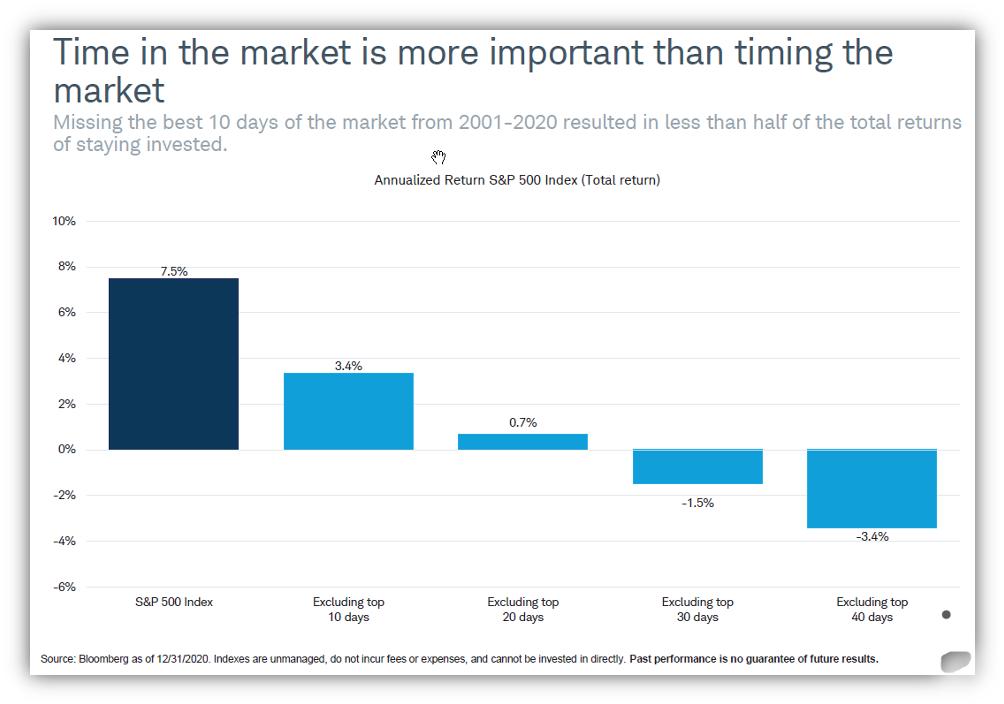

Over a 20-year period from 2001 to 2020, there were approximately 5,000 trading days, factoring in leap year and factoring out weekends and holidays. Investors who stayed fully invested in the S&P 500 and reinvested dividends earned an average of 7.5% on an annualized basis over that time period.

Now let’s assume an investor, trying to time the market, misses the 10 best days in the market over that same 20-year period. As the graph shows, that investor’s annualized return drops down to only 3.4%. Missing the top 20 days means that investor made less than 1% per year over those 20 years.

“Over the last 20 years or so, seven of the 10 best days in the market happened within two weeks of the 10 worst days,” says Brian. “The bottom line is, the market is just too unpredictable not to be in it.”

Staying invested over an extended period of time smooths out the effects of volatility and increases your chances of getting the positive returns that the market has historically provided.

“We never know when one of those top 10 or top 20 days are going to happen,” says Brian. “If you’re sitting on the sidelines, waiting for the next shoe to drop, you run the risk of missing out on something much better.”

IS NOW THE RIGHT TIME TO GET BACK IN?

For investors who have money on the sidelines, the question then becomes, when is the right time to get back in? When his clients ask this, Brian always follows up with another question: What is the purpose of that money? If it is money earmarked for five, 10 to 20 years down the road, the time to get back in is now.

But if the money is for a short-term purpose, for example, a first car for your kid who turns 16 next year or a home remodel in a few years, Brian suggests taking a more conservative approach. While bonds are suffering from severe illiquidity, a short-term CD can provide some low-risk returns, albeit meager, while ensuring that money is available when it’s needed.

MORAL OF THE STORY

A measured, strategic approach to investing will always pay off in the long run. Leveraging a solid financial advisor can help build your portfolio to weather the ups and downs that are inevitable in the markets. And Brian stresses that those good days will come again.

“If you look at the current situation, we just went through one of the biggest economic shocks of our lifetime with COVID, where the government created $7 trillion out of thin air in a $21 trillion economy.

We basically created a third of our economy overnight,” says Brian. “But on the other hand, our economy is as strong, deep and diverse as it’s ever been in the history of our country. So, when this passes, and it will, the rest of the world will continue to look at the U.S. as a world leader, economically, and that bodes well for the stock market.”

For questions about the market and positioning your own nest egg for growth now and into the future, CWA is just a call or click away. Feel free to contact our team to talk to a CWA advisor about scheduling a complimentary consultation.