A CWA INVESTMENT NEWS OP-ED

by Brad Sanders

CWA Digital News Investments Editor and Strategists at Tectonic Advisors Brad Sanders has covered the problems in China since 2010. You may even remember some of his stories encouraging readers to go to YouTube and search for “CHINA GHOST CITIES” and “CHINA GHOST MALL”. If you had, you would’ve seen the vastly built, yet uninhabited, cities and malls that perfectly embody the thing from which all of China’s stock, debt and real estate market problems stem. And that thing is leverage.

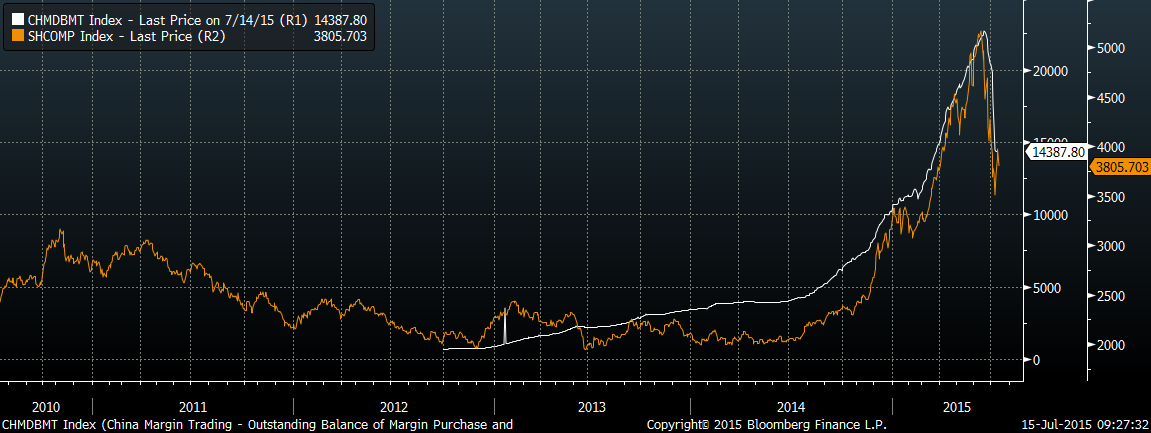

On June 15 of this year, the Shanghai Composite Index hit a high of 5205. Exactly a month later as of this writing, the index sits at 3805, down just shy of 27 percent. More than 1500 stocks remain halted on the Chinese market, and the government is scrambling to find ways to prop the market up in order to avert full scale panic. The Chinese market has lost over two-thirds of what U.S. markets did in 2008 in roughly four weeks!

The meteoric rise in China’s stock market since 2012 has been in direct proportion to the amount of margin debt that has been created. The chart below — with the orange line representing the Shanghai Composite, and the white line representing outstanding margin debt – illustrates the direct correlation. They are nearly lockstep. As we have learned countless times in the U.S. – most recently after the dotcom bubble burst – this type of rampant speculation creates faux wealth in markets, is transient in nature, and never ends well for investors and for markets.

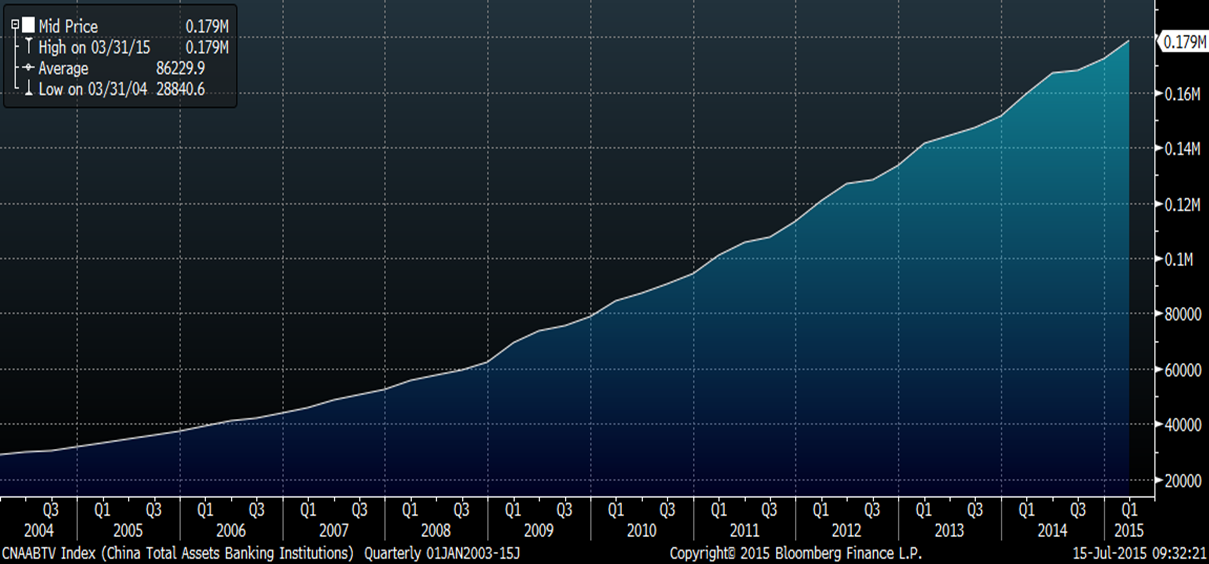

Problems in China also extend to their banking system, where banking assets have risen a whopping 500 percent since late 2004.

This is quite simply impossible to do without creating vast amounts of excess and bad debts that need to come out of the system at some point. And it appears that the time may be now. The damage in China has been somewhat contained so far, and has taken a backseat to the Greece and Grexit negotiations that have been more center stage. Both of these countries, however, represent risks that CWA investment strategy has accounted for in portfolio positioning for years. Macroeconomic issues are hard to time, which is why prudent investment strategies and risk management is always important – and not something that you can turn on and turn off on a whim. Five short weeks ago, China’s markets were up 113 percent over the previous year, and many wire houses were pitching massive investments in China to their clients.

Markets are fluid. Things move very fast and can change on a dime. This is why we have, and will continue, preaching prudence and discipline in our risk management processes. Investing is a marathon, not a sprint. If China continues at this rate, there’s a good chance those investors who’ve taken on debt to invest in its markets recently, will continue to see their savings and income sit precariously in the midst of monumental unrest — quite possibly, never even seeing the finish line.