Find out if your net profit is in line with the industry averages

The last three years have been a roller coaster for dental practice owners. From COVID closures to the stimulus-fueled production boom to the possibility of a prolonged recession, doctors have shown remarkable resiliency in keeping their practices healthy and profitable.

The question is, what exactly is a healthy net profit these days? Should dentists expect the same profit margins they enjoyed before 2020? Or is there a new normal to which the industry should steer itself for the near future?

“Like most industry trends, the answers lie in the data,” says CPA and Financial Advisor Brittany Frazier.

Each year, CWA compiles client data across six specialties to create the How Does Your Practice Compare? Report, a comprehensive benchmarking tool for doctors to compare their numbers with industry averages.

“In a 2020 article, I described net profit as the “heartbeat” of a practice,” says Brittany. “It’s the most direct metric to check the pulse of your practice, and the Dental Practice Comparison Report makes it easy to see how your compare.”

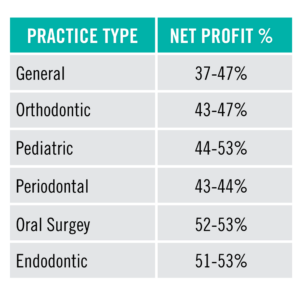

According to the latest report, a healthy 2022 net profit should fall in the following ranges:

Net Profit Range 2022, Per Specialty*

*Due to economies of scale, a multi-doctor practice would lean higher in the range, whereas a single doctor practice can typically expect to be in the mid to lower range.

“If your net profit fell into one of these ranges, congratulations,” says Brittany. “Even still, it’s always wise to keep an eye on areas you could be doing even better.”

If your net profit came in lower than the averages, Brittany emphasizes not to beat yourself up.

“These are extraordinary times,” says Brittany. “The first step is to arm yourself with the tools to diagnose your practice, then take steps to get your net profit back in line with the averages.”

FOCUS ON WHAT YOU CAN CONTROL

With all the external economic stressors we’re dealing with, it’s easy to get overwhelmed with factors we cannot control.

“That’s why I start by shifting my client’s mental outlook from a fear-based approach to a more data-centric, goals-based approach focused on what we can control,” says Brittany. “Things like how many new patients the practice is bringing in and how much is it writing off.”

Brittany also suggests taking a step back to make sure there is a rock-solid, goals-based financial plan in place.

“By leveraging the advice of a trusted CPA or advisor, it’s easier to pinpoint areas that need attention and put a solid growth strategy in place,” adds Brittany.

IDENTIFY AREAS TO IMPROVE

“For most practices, the first area to look at is expenses,” says Brittany. The report not only shows direct and fixed expense averages, but it also breaks them out with detailed expenditures under each. For example, how did your lab fees compare to the averages, and how much did you spend on drugs and supplies?

“If you find yourself above the averages, you’ve found a good place to focus on for improvement,” says Brittany.

The 2022 report shows that fixed costs increased more than in the past — no surprise there. Brittany says what is surprising, though, is the types of fixed costs that rose the most.

“It’s not the expenses like staffing and supplies and lab that increased more than expected,” said Brittany. “It’s the lesser fixed costs that sharply increased, like subscriptions and janitorial.”

Then again, Brittany says expenses may not be the reason profits are low.

“If your expenses are within range, yet profit was low, that’s a clear indication to focus more on increasing revenue,” says Brittany. “Revenue drivers include new patient flow, treatment acceptance and conversion speed.”

To help illustrate how the factors work together to determine net profit, use the following profitability formula.

REASSESS YOUR INSURANCE WRITE-OFFS

According to Brittany, taking a close look at insurance write-offs is essential, as they factor heavily into profitability.

“I’ve seen clients who increased their revenue but didn’t see a jump in net profit,” she said. “Upon looking deeper, we saw the practice only got paid 60 cents of every dollar of revenue.”

This percentage will vary dramatically based on whether the practice is 100% insurance driven versus fee-for-service only. Brittany suggests talking to your CPA or contacting CWA to determine the “normal” range for your practice type.

“As practices raise fees to keep up with higher operating costs, it’s imperative to maximize cash flow by making adjustments with insurance providers,” says Brittany.

CHECK YOUR COLLECTIONS RATE

Another important metric of practice health is the collection rate, which Brittany says should be around 98% of adjusted production.

Collections rates out of the 98% range could indicate a variety of issues, such as comping too many procedures or collections procedures aren’t as efficient as they should be.

“Whatever the reason, all collections systems must function correctly to ensure a healthy profit line,” added Brittany.

Ultimately, it’s about knowing your practice data, how it’s changed over time and what those trends tell you. It’s not an easy thing to pin down, as Brittany says doctors are often too busy running their practice to properly analyze their numbers and create a solid growth strategy.

“That’s why having a trusted advisor help you put the right profit-driving systems in place will help in the short term and better prepare your practice to weather the next storm,” added Brittany

To learn more about optimizing your net profit or get answers to any other business or personal finance question, a CWA advisor is always here to help. Set up your free consultation today.