What you can and cannot deduct from your next trip

Travel is more expensive than it has been in years, but business owners don’t need to cancel a scheduled trip solely because of inflated costs. If you map out your trip and record your expenses wisely, the business-related travel tax deduction can make it more affordable.

Dental practice owners have many reasons to travel for business: conferences, continuing education, to see their financial planner in Dallas. Knowing the rules and planning well before your next trip can make all the difference, Senior Tax Research Manager Yunnice Chang said.

“The IRS has rigid rules regarding business travel,” she said. “Trips need to be ‘ordinary and necessary’ to the business and not lavish. However, the definition of these IRS terms are a bit vague. Owners can use discretion here and define what is considered reasonable under their given circumstances.”

The IRS has guidelines for business-related travel deductions that every business owner should be aware of before their next trip, including:

- Travel by airplane, train, bus or car between your home and your business destination.

- Fares for taxis or other types of transportation between an airport or train station to a hotel, from a hotel to a work location.

- Shipping of baggage and sample or display material between regular and temporary work locations.

- Using a personally owned car for business which can include an increase in mileage rates.

- Lodging and non-entertainment-related meals.

- Dry cleaning and laundry.

- Business calls and communication.

- Tips paid for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to the business travel. These expenses might include transportation to and from a business meal.

“The IRS has also privately ruled that expenses for an employee’s additional night’s lodging and an additional day’s meals over the weekend at a temporary business location after business was concluded are ordinary and necessary business expenses,” Yunnice said.

So overall, the range of what this deduction includes is broad: not only transportation costs but all expenses incident to travel, such as those for lodging, meals, telephone, cleaning and laundry.

What it does not cover, generally speaking, is an accompanying spouse, dependent, or other individual on a business trip or to a business convention. If the accompanying spouse or guest is also an employee, per diem requirements can also be taken into consideration.

WRITE THIS DOWN

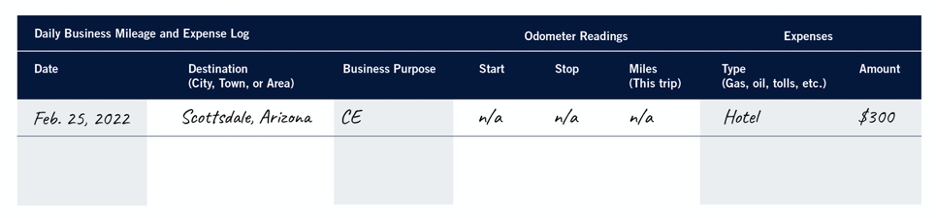

Before leaving for your trip, have a plan to record your deductible expenses. Proper documentation is time intensive, but documenting near the time of the event (like after dinner, when the amount including tip is top-of-mind) is best.

“The taxpayer should maintain an account book, diary or similar statement and documentary evidence,” she said. “In addition, a record made at or near the time of the expenditure, supported by sufficient documentary evidence, has a high degree of credibility.”

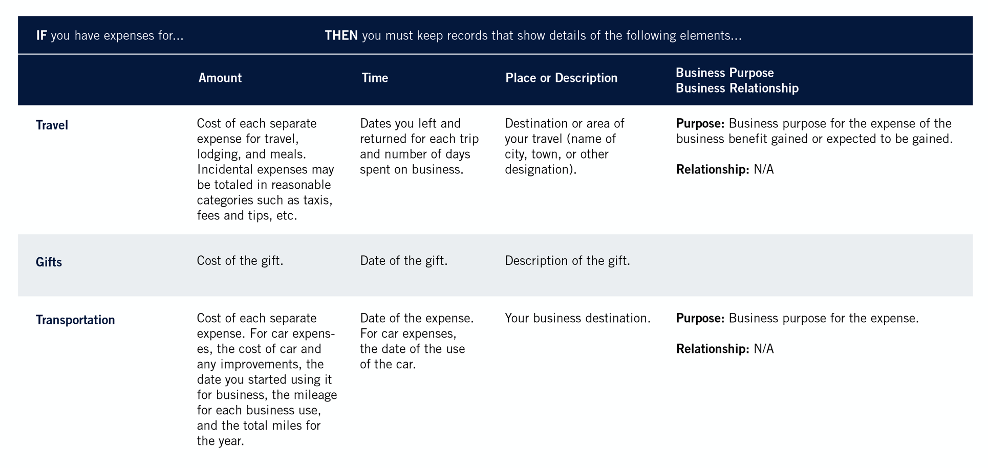

Adequate records or evidence should include amount of the expense, the time and place of the expense, the business purpose of the expense, and the business relationship. You’ll also need to keep receipts in case of an audit, which can be the physical paper copy or even just a picture of the paper receipt. The IRS has provided an outline of documentation requirements in the table below.

It’s important to also note that, in the event of an audit, the IRS guidelines state, “Travel expenses for conventions are deductible if you can show that your attendance benefits your trade or business.”

“This means you need to have an explanation on how the trip will help your business make money,” Yunnice said. “You don’t have to show an immediate profit, but you must expect the trip to create profit for you at some point in the future, and you need to write this reason down in your records.”

It can be as simple as recording how your business duties and responsibilities tie into the program or agenda of the convention, for example. The rules become far stricter when the convention is held outside North America or on a cruise ship.

FOREIGN BUSINESS TRAVEL

If you travel outside of the country purely for business purposes, all your travel expenses of getting to and from your business destination are deductible.

However, if you spend part of your time in a foreign country, say, wine tasting with your spouse, you have to allocate your travel expenses and only deduct the amounts allocated to business.

There are specific instances where differentiating between personal and business expenses on a foreign trip is not required; in this case, all four requirements need to be met:

- The foreign travel does not exceed one week.

- Non-business time is less than 25% of the total time spent on the foreign trip.

- Personal vacation is not a major consideration to make the trip.

- The taxpayer could not and did not exercise substantial control over arranging the trip abroad.

“Because of the potential for abuse, foreign travel expenses are scrutinized closely by the IRS” Yunnice said. “Good documentation is an absolute must.”

Traveling is just one piece to the tax strategy puzzle. Our financial planning teams can create a financial plan that is unique to you and your business needs.